Financial Services Authority (FSA)

Solvency II delay does not mean insurers can relax, says Montalvo

A delay to Solvency II implementation does not mean insurance firms can put preparations on hold, says Eiopa executive director

Delayed Basel trading book review will be broad, say supervisors

Basel Committee is expected to consider wide range of topics, including VAR, liquidity, CVA and the line between banking and trading books - but overall capital requirements are not likely to change

Cofunds appoints new risk and compliance director

UK investment platform Cofunds appoints Paul Miller as risk and compliance director

Three members of family jailed for boiler-room fraud in UK

Three members of family jailed for boiler-room fraud in UK

The Fed commitment letter process is alive and well, say Isda panellists

FSA's Bailey says the commitment letter process is better for firms than having the regulator "kicking over their books"

FSA urged to take direct action against liquidity swap ‘malpractice’

The British Bankers' Association (BBA) has called on the FSA to pursue individual cases of liquidity swap ‘malpractice’, rather than imposing new industry-wide regulations on the transactions

Brokers welcome Iosco commodity derivatives supervision principles

The recommendations of global regulators to harmonise commodity derivatives regulation have received praise from brokers for not trying to divide 'speculation' from 'hedging'

Uncertainty reigns

Uncertainty reigns

Obstacles facing dealers' dream of a global OTC data repository

The database race

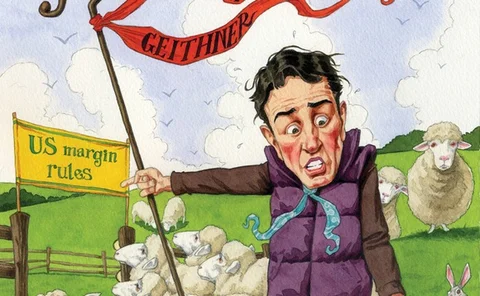

Foreign regulators leave US isolated on uncleared margin rules

The extraterritorial application of US uncleared margin proposals will make it tough for US banks to compete with their foreign counterparts unless the proposals are copied by regulators elsewhere

Risk Japan 2011: Japan, Europe need to team up to address Dodd-Frank extraterritoriality

Speakers on a panel at Risk Japan 2011 in Tokyo on August 30 debated the effects of international regulatory developments on Japanese financial institutions. Some parties believe Japan needs to team up with Europe to push back on Dodd-Frank…

Promontory hires Newman and Gould to lead greater China office

Frank Newman, former US Treasury deputy secretary, and Ronald Gould, ex-UK FSA senior adviser, join the consultancy's China operations

Short-selling bans spark confusion over index trades and extraterritoriality

Dealers say volumes have been light as market participants try to work out scope of bans – with confusion arising on index trades and the geographic reach of the rules

LSE to close TRS once sale has been approved

The LSE is planning to close the TRS approved reporting mechanism it has conditionally bought from the FSA

Hedge funds not systemically risky, but UK regulator issues caveats

UK FSA's Hedge Fund survey and Hedge Fund as Counterparty survey find systemic risk low, but it does offer limited warnings

UK FSA fines Willis £6.9 million for anti-bribery failings

The FSA has fined insurance brokerage Willis £6.9 million for failures in its anti-bribery and corruption systems and controls relating to payments to overseas third parties

Editorial: Protecting privacy

Regulators have not produced a new code for private banking and wealth management. They have simply allowed new rules for retail products to creep into the wealth space

ETF providers hit back at 'hearsay' in the press and regulator concerns about synthetic ETFs

ETF providers have been angered by the continuing focus on synthetic ETFs by regulators such as the Bank of England and the IMF. But they are particularly concerned about the bad press coverage.

OpRisk Europe 2011: Video

OpRisk Europe speakers and delegates give insight into the 13th annual OpRisk conference

Concern over accuracy of RWAs grows

A weight on their minds

FSA fines Bank of Scotland for mishandling customer complaints

The FSA has fined Bank of Scotland for mishandling customer complaints relating to retail investment products

Criminal minds and increased surveillance

All you survey

FSA: UK banks failing on money-laundering controls

Two banks under investigation and more could follow in crackdown on inadequate safeguards

Cole: FCA will be more interventionist than FSA

Margaret Cole of the FSA tells participants at a CSFI event that a change in culture from the FSA to the FCA will allow for a more proactive regulator