Asset liability management

Practical considerations for effective liquidity management in financial institutions

Strategies and best practices for ensuring financial stability and resilience

ALM technology systems 2023: market update and vendor landscape

Chartis' 2023 ALM research report returns to the key themes highlighted in the 2021 report. This update re-evaluates the complex ALM framework, which broadly comprises distinct segments that include funds transfer pricing, liquidity risk management and…

Incorporating climate risk into ALM frameworks at banks

In this webinar convened by Risk.net in collaboration with SS&C Algorithmics, experts discuss the challenges and benefits of incorporating climate risk into asset-liability management frameworks at banks

ERM reboot: how leading insurers are turning risk decisioning into strategic advantage

An expert discussion exploring how leading insurers are adapting ERM systems in support of a wider range of opportunities, helping to avoid losses, navigate unstable markets and maintain a strong reputation

Incorporating climate risk into ALM frameworks for banks

Banks are coming under increasing regulatory pressure to incorporate climate risk into their risk management frameworks. An emerging focus is incorporating climate risk into the asset-liability management (ALM) function. This webinar explores this new…

ALM and liquidity risk reporting greatly enhanced by big data applications

Sponsored video: Luis Mataias, IBM Watson Financial Services

Leading the way in the risk management (r)evolution

Sponsored feature: Prometeia

Insurers must perform balancing act

Winners' Circle: RBS

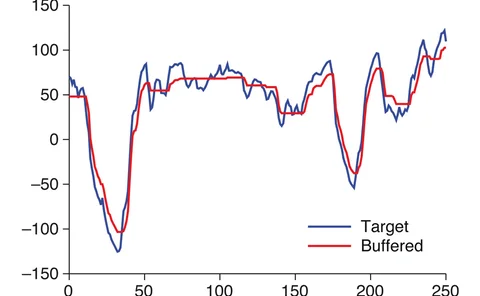

Stress testing in non-normal markets via entropy pooling

Ardia and Meucci introduce a parametric entropy pooling approach to portfolios stress testing

Basel to unveil ‘Pillar 1-lite’ approach to rate risk

First public consultation expected this month in long-running project

In-depth introduction: Bonds

Interplay between rules could reshape demand for government debt

Tail risk premiums versus pure alpha

Tail-risk skewness, rather than volatility, is correlated with risk premiums

Multiperiod portfolio selection and Bayesian dynamic models

Kolm and Ritter present a multiperiod, multi-asset selection model with transacion costs, kept computationally tractrable

Impact study postponed for Basel rate-risk project

QIS was due to get under way last month but will now start in mid-2015

Basel rates split heralds soft landing, banks hope

First consultation paper on banking book interest rate exposure is expected in March

Banking book rate risk project splits in two

Regulators working on Pillar II guidance as well as fixed capital regime

Optimal trading under proportional transaction costs

The theory of optimal trading under proportional transaction costs has been considered from a variety of perspectives. In this paper, Richard Martin shows that all results can be interpreted using a universal law through trading algorithm design

US regional banks prepare for rising rates

With regulators watching closely, US banks are reining in the duration of bond portfolios

Portfolio construction and systematic trading with factor entropy pooling

Construction of large portfolios consistent with investors' views and stress test scenarios is a challenging task, considering the volume of information to be processed. Attilio Meucci, David Ardia and Marcello Colasante introduce a technique that…

EC bank reforms would leave lenders unable to hedge

European proposal limits risk management tools to clearable swaps only, preventing options-based hedges