Insurance

Libor/OIS spread challenges insurers' risk management programmes

Spread carefully

Systemic risk debate hots up over variable annuities and ILS

In defence of the non-traditional

National regulators ramp up efforts to combat low rate threat

Interesting times

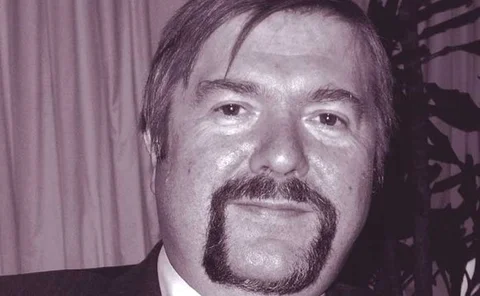

Van Hulle: Long-term investment agenda must not side-track Solvency II

Political focus on promoting long-term finance could be detrimental to insurance industry, warns European Commission's former Solvency II leader

Q&A: Karel Van Hulle on Solvency II delays and the challenges ahead

Beating the negative forces

Loans – why now?

Sponsored statement: BNY Mellon

‘Flawed’ standard formula currency risk calibration needs revision - Insurance Europe

Current specification is ‘counter-intuitive’, say industry experts

Solvency II set for inconsistent soft launch, lawyers warn

Absence of legal powers to enact guidelines in some jurisdictions threatens Eiopa’s objectives

Insurers fear non-recognition of equivalence under Solvency II interim reporting requirements

Group supervisors to determine whether European or local rules apply to non-European entities

UK insurers ‘must adapt to dual compliance burden’ as new regulators begin to flex muscles

Firms braced for duplication of compliance work amid signs that framework for regulators to share information is not working, lawyers warn

Lloyd’s insurers challenged by internal model change policies

Questions on parameterisation remain unanswered by European rule-makers

Allianz leads German insurers in guarantees shake-up

Insurers developing new products to reduce exposure to low rates

Insurers increase equity exposure despite risk management challenges

Joining the equity rotation

Combating the collateral crunch

Sponsored statement: BNY Mellon

Extensive reporting guidelines in Solvency II interim measures 'will challenge insurers'

Eiopa says measures will help supervisors and insurers prepare for Solvency II

Perpetual sub debt from insurers appeals to investors

Perpetual dawn

Insurers 'should be exempt from initial margining requirements' on ALM hedges

No economic need for initial margin on non-centrally cleared derivatives, argues Insurance Europe

Variable annuities do not pose a systemic risk - Geneva Association

Industry think-tank rejects product’s designation as a non-traditional, non-insurance activity

Italian insurers question benefit of Solvency II long-term guarantees package

Matching adjustment and countercyclical premium inadequate for Italian insurers’ needs

Solvency II equivalence rules must not threaten European insurers - Skinner

Rules must not cause 'ill effects' to firms with international business, warns senior MEP

US insurers expect less benefit from Orsa than European firms

European life insurers are particularly challenged by Orsa implementation, finds survey

Insurers eye longevity risk trades with Canadian and Dutch pension schemes

Influx of new swap intermediaries and improved risk modelling to spur expansion

Insurers explore exchange-traded funds to boost yield

Exchange-traded future