Insurance

The extrapolation conundrum

The extrapolation conundrum

Significant longevity issue in China but third-party risk transfer ‘some way off’

China is greying quickly, but low penetration of pensions and life insurance mean little likelihood of a UK-style longevity swap market emerging

New longevity indexes ‘a step forward’ in developing tradable market but challenges remain

New longevity indexes ‘a step forward’ in developing market but challenges remain

Ultra long-dated UK gilts could provide data to value long-term liabilities

Ultra long-dated UK gilts could provide data to value long-term liabilities

Aegon €12 billion longevity swap ‘shows appetite of capital market for diversifying assets’

Aegon €12 billion longevity swap ‘shows appetite of capital market investors for diversifying assets’

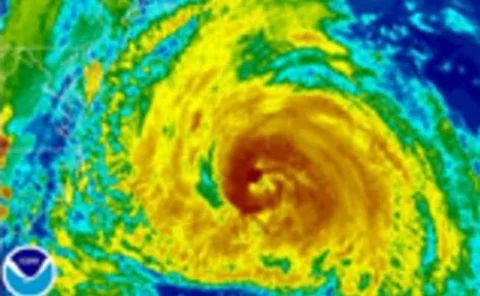

Cat bonds set for boom year as new investors eye market

Despite a subdued level of activity in 2011, the cat bond market is expected to boom this year as new investors pile in and rates harden in the traditional reinsurance market. Thomas Whittaker reports on how the cat bond market is evolving

American VA providers de-risk to combat market volatility

Staying steady

The volatility challenge

The volatility challenge

Rolls-Royce longevity swap highlights growing cross-border appetite of reinsurers

Rolls-Royce longevity swap highlights growing cross-border appetite of reinsurers

Sovereign risk poses greatest threat to European insurers

Sovereign risk poses greatest threat to Euro insurers

The road to US Solvency II equivalence will be a difficult one

The long, hard road

Alternative liability modelling techniques

Lessons from America

Meeting the volatility challenge of guaranteed products

No guarantees

European Insurers face downgrades amid continuing sovereign debt crisis

Generali subsidiaries and Groupama receive downgrades; Aviva placed under review

Sovereign debt crisis spurs investment in cat bonds

Life insurers and pension funds using insurance-linked securities as diversifier, as deal activity jumps in fourth quarter

Eiopa to perform insurer stress test next year

Tests will not be based on QIS 5 calibrations, says Montalvo

New insurer 'to cut buy-out costs' for DB schemes

Long Acre Life will use mutual concept to reduce ultimate buy-out cost for pension funds

Dutch regulator urges insurers to report under Solvency II in 2012

Reporting under market-consistent framework would assist transition to new regime, says DNB

Book review: Risk Management for Insurers

Risk and reward

Insurers look to optimise curve-fitting technique

The learning curve

Plans for US Orsa gather pace

The American dream