Insurance

Bail-in tool required to resolve systemic insurers, says Bank of England

UK supervisor needs extended powers to fulfil FSB attributes for resolution of systemic institutions

Cat bond ‘lite’ structures raise contamination risk and insolvency fears

Investors and lawyers voice concerns about using segregated accounts structure to issue streamlined cat bond instruments

Divergence fears over insurer resolution proposals

Scope of Financial Stability Board proposals to give supervisors extended powers ‘unclear’

Insurers developing internal model risk calibrations for non-standard credit assets

Underlines growing strategic importance of infrastructure bonds and MBS, finds survey

Q&A: NAIC's CEO and president on group supervision, systemic risk and captives

The standard-setters

Insurers prepare for interest rate hikes

Rate of relief

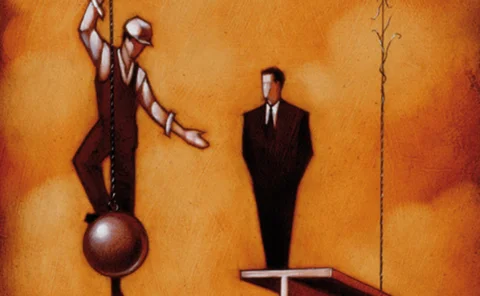

Global insurer systemic risk proposals stoke controversy

Saving the system

Longevity risk under Solvency II

Longevity risk under Solvency II

NAIC calls for coordination of US and international systemic risk regimes

Financial Stability Board's G-Sii regime should be consistent with US Sifi rules, says NAIC chief

Swedish life insurers weigh occupational pensions spin-off ahead of Solvency II

Directive threatens to put hybrid pensions providers at a competitive disadvantage and force them to split-up businesses

Insurers oppose Eiopa power grab

A new European supervisor would be ‘unpleasant’ for the insurance industry

Cat bond sponsors tempt investors with diversified perils and geographies

Innovative structures seek to break dominance of US wind peril over ILS market

Take part in Insurance Risk/BNY Mellon's collateral management survey

Are insurers prepared for central clearing of OTC derivatives?

New Danish solvency rules ‘will increase capital requirements’

Sampension CFO says simplifications welcome but standardisation has drawbacks

Prudential Financial’s Sifi appeal casts doubt on US G-Sii powers

Disconnection between domestic and international Sifi processes means regulators could lack legal power to enforce G-Sii measures in some cases

Solvency II extrapolation proposals feed volality debate

The European Insurance and Occupational Pensions Authority’s report on the long-term guarantees assessment has reignited the debate on the methodology for determining the risk-fee term structure. The authority’s proposals for a long extrapolation period…

Insurer participation in testing European project bond debut ‘exceeds expectations’

Long maturities and improved rating lure firms into Spanish gas scheme bonds

Supervisors to assess whether new powers needed to impose capital charge on G-Siis

US state regulators warn of ‘two-tier’ system developing

Dutch insurers tackle regulator on solvency impact of France downgrade

Drop in ECB AAA curve will also affect German insurers’ guarantees reserves

Death benefits in UK annuities 'should be eligible for revised Solvency II matching adjustment’

Products with five-year guarantee period should be deemed immaterial under Eiopa’s new criteria, say actuaries

New EU state aid guidance may force insurers to adjust capital structure

Lawyers split on whether subordinated debt will be made convertible by law