Insurance

Solvency II interim measures a 'win-win' for insurers and supervisors - Bernardino

Guidelines necessary to achieve convergence and improve quality of preparations, says Eiopa chairman

Insurers target value-in-force monetisation transactions to boost regulatory capital

But securitisations still a challenge, say experts

UK annuity providers review credit risk strategies

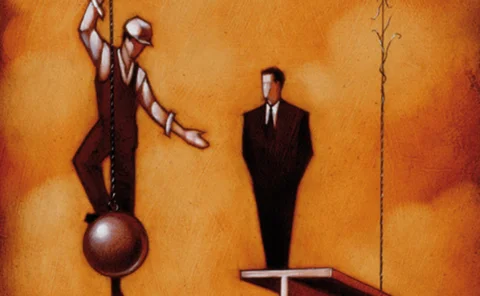

Balancing act

The infrastructure investment challenge for insurers

Financing the growth agenda

Australian insurers and banks gear up for regulatory changes

Regulator seeks harmonised risk management and governance across the industry

Insurers bolster inflation protection

Hedging assets sought to combat escalating risk of interest rate and inflation spike

UK regulator right to retain flexibility to force changes on internal models

Head of the PRA plans to use early warning indicators in supervisory work, notwithstanding the risk of EU challenge

US insurers target European commercial real estate debt

Attractive yields and supply demand mismatch spur interest

Better risk data vital if insurers to boost disaster coverage

Steps to improve risk modelling needed if Europe wants insurers to increase cat risk exposure, say experts

Singapore presses ahead with new ERM framework for insurers

Regulator soothes industry concerns over tight compliance deadlines

Standard formula’s treatment of long-term investments 'flawed'

Standard formula data sets and methodologies 'inappopriate' for securitised products and secured investments, warn experts

Unprepared insurers delay South Africa's risk-based solvency regime

Third quantitative impact study and economic impact study to be launched later this year

Asia-based cat bond issuance unlikely

A catastrophe bond from an Asian-based issuer is unlikely in the near term due to the high cost relative to traditional reinsurance

‘Prescriptive’ ComFrame criticised by American insurance industry

Fears that global cooperation and coordination initiative is evolving into strict regulatory regime

Libor/OIS spread challenges insurers' risk management programmes

Spread carefully

Systemic risk debate hots up over variable annuities and ILS

In defence of the non-traditional

National regulators ramp up efforts to combat low rate threat

Interesting times