Counterparty credit risk

Q&A: counterparty risk - Spot the differentiation

The credit quality of product issuers has become a prime concern following the downfall of US investment bank Bear Stearns. Sophia Morrell asks seven industry players - issuing banks, an index provider, a distributor, a risk analysis and pricing company…

Really too big to fail?

Are bulge-bracket investment banks really too big to be allowed to fail? Despite the upheavals such a failure would cause, the consequences may have been overblown, argues David Rowe

EC outlines changes to CRD

The European Commission (EC) has launched a public consultation on more than 50 technical changes to the Capital Requirements Directive (CRD).

On thin ice

Following the near-collapse of Bear Stearns, even trades conducted with interbank dealers can no longer be considered risk-free. With so much of the derivatives market concentrated in the hands of a few dealers, what would happen if a major counterparty…

Counterparty risk and CCDSs under correlation

Counterparty risk under correlation is relatively unexplored in the financial literature. Damiano Brigo and Andrea Pallavicini extend previous analysis beyond swap portfolios. A stochastic-intensity jump-diffusion model is adopted for the default event,…

Going the wrong way

Counterparty Credit Risk

Counterparty risk and CCDSs under correlation

Hybrid Products

Wrong way risk modelling

Beyond its potential impact on counterparty risk exposure, the wrong way risk arising in some derivatives transactions raises important modelling challenges. Christian Redon presents two suitable models based on conditional expected exposure. Among…

Industry group warns of risk of derivatives crisis

The derivatives industry urgently needs to improve its transaction handling and risk transparency if it is to avoid a crisis, an industry taskforce said yesterday.

Hedge funds solve the risk culture puzzle

As recent reverses amply demonstrate, risks beyond investment risk can cause even the most sophisticated hedge funds to take a battering. Navroz Patel finds out about leading managers' greatest fears, and how they are tackling thorny issues such as…

The Monte Carlo mindset

There is a rich seam to be mined in the provision of tools to calculate counterparty credit risk. Clive Davidson looks at what's on offer so far, and what could be coming on to the market.

Regulatory fines moved into legal risk definition

According to a source close to the Basel Committee on Banking Supervision, the concept of legal risk will be explicitly broadened in the final version of the Basel II document, due out at the end of June – to include fines, penalties and punitive damages…

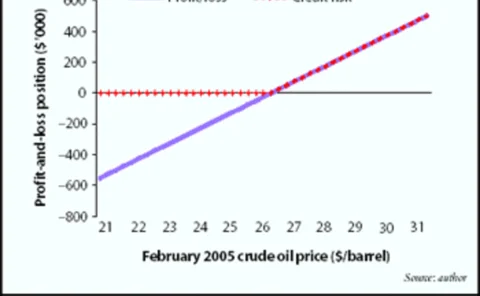

Measuring the value of clearing

Central clearing houses offer major advantages to the electricity trading industry, says UK Power Exchange’s Paul Danielsen. He sets out a practical example to demonstrate how UK power firms can benefit from clearing

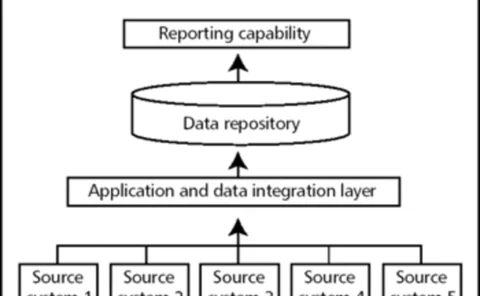

Getting it together

Data consolidation is now a vital foundation to any successful risk management implementation, as Dave Rose and Stuart Cook of The Structure Group report

Analysing counterparty risk

In an attempt to improve on existing regulatory approaches to derivatives counterparty creditrisk, Eduardo Canabarro, Evan Picoult and Tom Wilde present a new method based on expectedpositive exposure (EPE).

Sponsor's article > Reason for hope

One disappointing aspect of the Basel II deliberations has been the lack of any proposed change in the treatment of counterparty credit exposures. David Rowe argues that recent dialogue between the Basel Committee and industry representatives offers hope…

Analysing counterparty risk

In an attempt to improve on existing regulatory approaches to derivatives counterparty creditrisk, Eduardo Canabarro, Evan Picoult and Tom Wilde present a new method based on expectedpositive exposure (EPE). Using a one-factor conditional independence…

Bearing the brunt

Finance

Continuous-linked settlement: Extending to Asia

Continuous-linked settlement – the initiative designed to eliminate forex settlement risk – went live at the end of last year. But with only Australia and Japan represented in the first batch of currencies, what will CLS mean for Asia’s banks?