Counterparty credit risk

Waiting for CCP standards

Proposed standards for central counterparties clearing over-the-counter derivatives will be published in May, tackling contentious issues such as governance, margin practices and default management. Dealers are anxious to ensure the standards are…

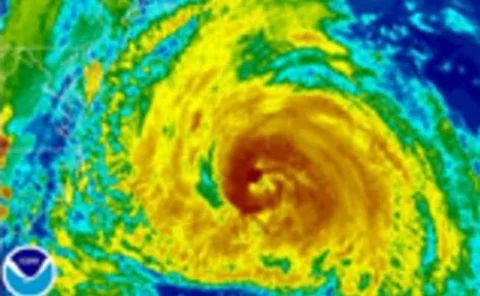

Cat bonds return

The market for catastrophe bonds dried up in 2008 and early 2009 as the financial crisis took its toll. Confidence is returning, helped by wide spreads and a re-think about the assets used to collateralise catastrophe bonds, but issuance has yet to…

State benefits for RBS

Jezri Mohideen, head of rates trading for Europe, the Middle East and Africa at RBS, talks to Alexander Campbell

LCH.Clearnet CEO calls rival 'reckless' as Fannie, Freddie clearing battle heats up

Politicians love the idea of central clearing, but with competition for this new business increasing, so are concerns some venues might not be robust enough.

Simply does it

Structured products have been used as a scapegoat for some of the problems that led to the financial crisis. But Cater Allen, the UK private banking arm of Santander, says transparent products can regain investors’ confidence. Clare Dickinson reports

Funds the key to unlocking Spanish market

Structured products distribution in Spain stalled during the financial crisis as banks turned away from open architecture. The answer seems to lie in fund-based products, for which the distribution networks remain open. Richard Jory reports from…

Counting the cost of counterparty risk

A few years ago no-one worried about counterparty credit risk. Then a year ago that was all anyone cared about. As markets begin to settle down, the shake-up could have longer-term implications for the structured products market. By John Ferry

Risk corporate survey 2010

Price is still the most important factor for corporates when choosing which dealer to trade with. However, a wide divergence in pricing among banks means transparency is now a key issue. By Matt Cameron, with additional research by Alexander Campbell,…

Reconsidering the fixed-floating mix

Yield curves for sterling, the euro and the dollar are the steepest they have been for well over a decade, leaving companies with outstanding fixed-rate debt and large amounts of cash on balance sheets facing significant negative carry. Many corporates…

A sting in the tail

After recent financial turmoil, market participants are thinking much more rigorously about ways to protect themselves against the possibility of rare but extreme events. However, effectively hedging tail risk is not straightforward. By Mark Pengelly

Risk Espana rankings 2010

Changing of the guard

ETFs & exchanges sponsored forum: Mitigating risk through the use of ETFs

The potential of ETFs to bring liquidity and mitigate risk

Exposing counterparty risk exposure

Banks have focused on improving counterparty credit risk management capabilities since the onset of the financial crisis. How are they changing systems to ensure accurate monitoring of exposures on a real-time basis?

Uncertain liquidity ratios

Like their counterparts elsewhere, South African banks are bracing themselves for a round of changes to Basel II rules. But it is the implications for liquidity and not capital that most concern market participants.

Bilateral counterparty risk with application to CDSs

Previous research on credit valuation adjustments (CVAs) with correlation between underlying and counterparty default, including volatilities of both, assumed unilateral default risk. However, the crisis prompted counterparties to ask institutions to…

Counterparty charge an act too far?

The Basel Committee shocked many bankers in December by unleashing proposals to significantly increase capital requirements for counterparty risk exposures. But industry participants argue the measures overlap with each other and could hike up capital to…