Counterparty credit risk

Contagion fears drive volatility

The takeover of a Spanish savings bank last month and rumours of funding difficulties at the country's financial institutions spook investors

Risk institutional investor rankings 2010

The resurgence of market volatility and growing regulatory uncertainty have made the past 12 months challenging for investors. In this difficult environment, respondents to Risk’s institutional investor survey voted JP Morgan the top provider of…

When market and credit risk collide

The financial crisis highlighted that interactions between market risk and credit risk could expose banks to greater risks than had been assumed. Banks are responding by altering their structure and the models they use – but it is by no means an easy…

Slow ahead for euro rates business

Investors have grown increasingly worried about exposures to eurozone sovereigns given the problems faced by Greece and others. Christophe Mianné, head of global markets at SG CIB, warns the second quarter will prove to be tough for the European rates…

Moody’s widens op risk definition for securitisation

Ratings agency breaks down boundaries of counterparty, credit and liquidity risk

Korean risk premiums exceed Thailand, ‘raised long term'

Tensions on the Korean peninsula mean CDS prices are likely to stay high for some time, analysts say

US investors still sensitive to counterparty risk

Counterparty risk remains a dominant theme for US investors, who are keen to analyse issuer credit ratings and credit default swap levels before buying a structured product. Richard Jory asks senior US industry figures how attitudes to counterparty…

Sovereign CDSs cause systemic concern

Increased protection selling on sovereigns raises fears about systemic risk

Energy Risk: What's coming next?

Energy Risk brings you a snapshot of what's moving and shaking the markets with a special look at energy credit.

China readies for launch of onshore CDS

Financial risk management tools seen as essential for Chinese bank development

New approaches to energy credit risk management

The aftermath of the financial crisis led to some innovative approaches to tackling energy credit risk. Pauline McCallion looks at developments and asks whether proposed US and European regulation will help or hinder innovation in this space

Interview: Darrell Duffie on credit risk modelling

Stanford University’s credit risk expert, Darrell Duffie, talks with Katie Holliday about changes in the modelling of credit risk within energy markets since the financial crisis

Sponsored feature: BNY Mellon – focusing clients on their core activities

Never has the need for efficient management around over-the-counter derivatives business been more crucial, or such a focus, as it is today. BNY Mellon discusses how, with its collateral management services, it has helped clients achieve greater…

Basel III: kill or be killed

The Basel Committee is trying to prevent a repeat of the financial crisis with a package of new rules, but banks argue the cure could be worse than the disease. After spending the past two months filling out spreadsheets on the impact of the proposals,…

Confusion over CVA

Dealers are becoming more disciplined in pricing credit – a lesson learned the hard way after the collapse of Lehman Brothers. However, banks are taking a variety of approaches, and some participants believe certain firms are habitually underpricing…

Waiting for CCP standards

Proposed standards for central counterparties clearing over-the-counter derivatives will be published in May, tackling contentious issues such as governance, margin practices and default management. Dealers are anxious to ensure the standards are…

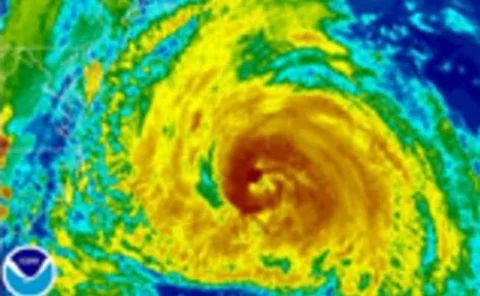

Cat bonds return

The market for catastrophe bonds dried up in 2008 and early 2009 as the financial crisis took its toll. Confidence is returning, helped by wide spreads and a re-think about the assets used to collateralise catastrophe bonds, but issuance has yet to…

State benefits for RBS

Jezri Mohideen, head of rates trading for Europe, the Middle East and Africa at RBS, talks to Alexander Campbell

LCH.Clearnet CEO calls rival 'reckless' as Fannie, Freddie clearing battle heats up

Politicians love the idea of central clearing, but with competition for this new business increasing, so are concerns some venues might not be robust enough.

Simply does it

Structured products have been used as a scapegoat for some of the problems that led to the financial crisis. But Cater Allen, the UK private banking arm of Santander, says transparent products can regain investors’ confidence. Clare Dickinson reports

Funds the key to unlocking Spanish market

Structured products distribution in Spain stalled during the financial crisis as banks turned away from open architecture. The answer seems to lie in fund-based products, for which the distribution networks remain open. Richard Jory reports from…