Monitoring counterparty risk post-Lehman

Many buy-side firms use CDS spreads as an indicator of potential risk amongst their counterparties. Jonathan Di Giambattista of Fitch Solutions looks at the drawbacks of taking spreads at face value and suggests ways of improving the process.

The Credit / Fitch Solutions survey gives empirical evidence of how the financial market events of 2008 have had a clear and lasting impact on counterparty risk managers. Nearly all respondents said their focus on counterparty risk management has intensified over the past year, and while most are hopeful a central counterparty solution will alleviate some of their counterparty risk, it is clear the need for diligent counterparty risk monitoring will persist for the foreseeable future.

One of the most striking results of the survey is that more than 80% of buy-side firms do not hedge counterparty risk while the vast majority of large sell-side firms do hedge. The survey also shows that buy-side firms have greater concentrations of counterparty exposures than the sell-side (buy-side firms have seen counterparty concentrations increase, on average, since the Lehman collapse).

This presents an interesting paradox whereby firms with the highest counterparty concentrations are the least likely to hedge counterparty risk. Most buy-side firms resort to closely monitoring counterparty credit risk, exposures and collateral quality, and managing counterparty limits as their primary – and perhaps only – means of mitigating counterparty risk.

Monitoring counterparty credit risk

Most buy-side firms engage in a multi-layered, and often multi-departmental, approach to monitoring counterparty credit risk. Two-thirds of those surveyed rely heavily on internal credit assessments, which are typically assigned by a central credit risk team. These centralised risk rating teams provide counterparty risk managers (CRMs) with a list of officially approved counterparties based on one or all of the following: external ratings, fundamental financial performance, market-based risk metrics, sovereign risk and qualitative assessments of terms and conditions with the potential counterparty.

Survey respondents said they engage in additional credit risk monitoring, primarily through observing movements in CDS spreads, to anticipate problems with ‘approved’ counterparties. If an internal credit assessment deems that a counterparty’s credit quality has degraded, there will likely be an impact to that counterparty’s limits, collateral requirements or ‘approved’ status. In this event, the CRM is required to take appropriate action to reduce or eliminate exposure to the downgraded counterparty. To avoid this unwelcome scenario, CRMs use CDS market signals to anticipate who on the approved list is prone to future downgrades, and proactively take measures to reduce exposure.

As one CRM said: “We actively monitor all our positions and compare them to new transactions. If we can add positions that are ofsetting or reduce risk, we will steer those towards counterparties where we have the largest exposures. We also monitor our banks rigorously. If we find that the credit risk is no longer suitable, we will actively reduce exposure.”

It comes as no surprise that nearly three-quarters of survey respondents monitor CDS spreads when managing their counterparty risk: the CDS spread is unique among credit risk signals in that it represents a consensus credit opinion from a diverse group of market participants. This one market price is used to derive both ordinal values such as relative credit risk levels by firm, sector or region, and cardinal measures such as probabilities of default for individual names or whole sectors and/or regions. CDS spreads for financial institutions are particularly informative as they are determined by counterparties’ trading risks of other counterparties.

In practice, however, the nature of the CDS market poses challenges that must be considered before explicitly using spreads in a risk management context. Looking at spread movements leading up to the Lehman default, CDS spot spreads often gave misleading signals. Graph 1 (below) tracks the spread levels of seven different entities with liquid contracts in the CDS market over a five-month period. At the beginning of the time series, all seven firms have nearly identical spread levels, but subsequently each firm trades with clearly different patterns. The fact that all seven entities were trading within a few basis points of one another on a single day tells us very little about how the firms will price relative to one another in the future. Therefore, there are some pitfalls to using spot CDS spreads to inform risk management decisions: given the dispersion of subsequent trading patterns, risk management decision-making requires better discrimination among firms trading with similar spread levels on a given day.

For these reasons, Fitch Solutions has implemented a CDS trading pattern-oriented methodology for our CDS Implied Rating model. The methodology, developed in 2006, performed admirably throughout the crisis: while all banks’ spot spreads stressed towards non-investment grade levels through Q4 2007, Bear Stearns was the first and only major bank to establish a non-investment grade trading pattern by December 2007. Lehman Brothers and Merrill Lynch were the second and third firms, respectively, to establish non-investment grade patterns in early 2008, correctly forecasting the order of future bank failures. While we observed Goldman, Citi and BoA flirting with non-investment grade spot spreads throughout 2008, these firms never established non-investment grade trading patterns in advance of the Lehman default.

Analysing CDS trading patterns, rather than spot spreads, yielded a clean, clear and timely set of relative risk signals that benefited CRMs throughout the credit crisis.

Using spreads to derive risk values

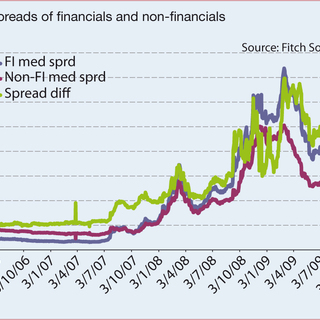

This real world test speaks to the utility of the CDS market as a relative indicator of credit quality, but what about the cardinal values derived from spreads? The spread levels observed during the peaks of the crisis implied unprecedented, and ultimately unrealised, future default rates. Graph 2 (below) shows the spreads of financial institutions and non-financial institutions throughout the crisis period. In March 2009 the CDS market anticipated that roughly 9% of financial institutions would default by March 2010. This unprecedented implied default rate held little credibility with market observers at the time, and provided credit strategists the world over with ample ammunition for bullish credit strategy recommendations.

Given that cardinal risk values provided by the CDS market through the credit crisis were neither believed nor realised, what drove spreads to such extraordinary levels? One possible explanation is that liquidity, or lack thereof, was responsible for the dramatic rise. Using dealer contributed CDS quotes, Fitch Solutions can observe the quoting frequency, bid/ask spreads on each quote from each dealer, and the dispersion of contributed quotes for each CDS name. We combine these data sets to produce a liquidity score for each credit that is comparable across entities, sectors and time.

Using this metric, we find that CDS market liquidity increased dramatically in the 12 months prior to the Lehman failure, and then retreated to historical lows in early January 2009. At the spread peak in March 2009, liquidity rebounded to 2007 levels, but was still well below 2008 liquidity.

When viewing the same time series by sector, we find that all sectors followed roughly the same liquidity pattern throughout the 2008 and 2009 time period. In looking at differences across sectors, however, we periodically observe a liquidity gap between financials and non-financials. We’ve plotted this liquidity gap, labelled ‘FI excess liquidity’ (i.e. difference in liquidity score between FIs and non-FIs) against median FI and non-FI CDS spread levels in Graph 3 (below). Here we observe that prior to February 2007 FIs were consistently less liquid than non-FIs, meaning FIs had negative ‘excess liquidity’. FI excess liquidity turned positive in dramatic fashion beginning in March 2007 and peaking in May 2007. Through March 2009, the movements in FI excess liquidity appear to lead corresponding movements in CDS spreads for both FIs and non-FIs.

While it is understandable how increased liquidity among financials correlates with nominal spread movements for the same sector, it is eye-opening to see how spreads on non-FIs are led by FI CDS contract liquidity. One possible explanation is that spreads of non-FIs are incorporating aggregate counterparty risk, as well as the name-specific default risks, loss given default and liquidity premiums. Somewhat ominously, FI excess liquidity last peaked in April 2009, possibly signalling another spike in CDS spreads for the first half of 2010.

While more research is required to better quantify the links between FI excess liquidity and CDS spread movements, it does appear that the concept of FI excess CDS liquidity can help CRMs assess the aggregate level of counterparty risk in the market. Given the interconnectedness of counterparties, such an aggregate benchmark is as useful as risk signals of individual names. As one survey respondent said: “Banks are highly correlated. Recent market events have demonstrated that as only very few banks went under, all banks felt the pain.”

Counterparty risk monitoring: A new framework

While this article has focused on how the CDS market can be used to monitor counterparty credit risk, it should be noted that the CDS market covers only the very largest of financial institutions. In order to maximise coverage of counterparty credit risks, CRMs should have ready access to agency ratings, internal ratings, fundamental financial data, CDS spreads and equity market signals for all counterparties. By monitoring a diverse array of signals and risk levels, CRMs will be best equipped to optimally manage counterparty exposures.

Doing so remains a practical challenge, however: while all this information is available from vendors, survey respondents listed managing and integrating disparate data sets as a leading challenge to monitoring counterparty risk. In response to this challenge, Fitch Solutions has streamlined the delivery of our financial institution credit risk data, making its consumption more practical.

The Credit / Fitch Solutions survey shows that monitoring counterparty credit risk remains a critical area of concern for both buy-side and sell-side firms. While most CRMs are making use of the CDS market for risk monitoring, it is important to look at the relative trading patterns of counterparties, as well as indicators of aggregate counterparty risk in the overall market.

Markets may have calmed considerably over the past year, but the level of overall liquidity in the CDS market indicates that market uncertainty persists, and CRMs should remain vigilant against future counterparty credit problems. The ongoing concerns of counterparty risk managers are well justified.

Jonathan Di Giambattista is Senior Director at Fitch Solutions

Email: Jonathan.DiGiambattista@fitchsolutions.com

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net