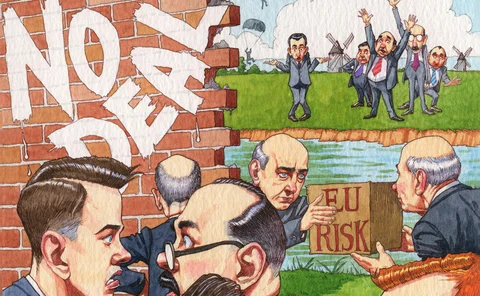

Brexit

As Brexit looms, Mifid transparency faces the chop

EU law and equivalent UK draft threaten to split and undermine trade disclosure rules

Libor fallback, Brexit and the problems with Cover 2

The week on Risk.net, November 17-23, 2018

Swaps users wary of hedge accounting hit from Brexit transfer

Uncertainty over exemption for novated trades may force hedgers to sacrifice netting benefits

Brexit drama muddies water for FX options market

Traders focusing on new dates – and scenarios – after domestic UK criticism of proposed deal

Eurozone banks bet on 2024 MREL deadline to ease Brexit pain

SRB says legacy English law bonds ineligible, but BRRD grandfathering could solve problem

How to stress-test portfolios for Brexit and trade wars

Options markets point to likely market moves in different scenarios, write StatPro risk specialists

Credit data: rate hikes put borrowers on the rack

Default risk climbing for heavily indebted companies as US rate hikes continue, says David Carruthers

Imperfect harmony: industry balks at EU foreign venue rules

Proposal could force non-EU platforms to choose between following Mifid II or ditching EU firms

Esma’s Brexit novation relief falls short

Proposed clearing reprieve too narrow to alleviate burden of mass swaps migration

Industry fears EU ‘Google tax’ will hit trading venues, CCPs

Broad wording of digital services tax could place market infrastructure in firing line

JP Morgan slashes UK exposures ahead of Brexit

Derivatives and securities exposures halved since June 2016

EU prop trader regime could capture foreign firms

Group capital rules may be applied to third-country arms of EU market-makers

Libor, Brexit and a renewed margin dispute

The week on Risk.net, October 13–19, 2018

The initial margin challenge – Why the bang just got bigger

With uncertainty abounding as the industry heads into the final phases of implementation of the uncleared margin rules (UMR), Jean‑Paul Botha, delivery lead of financial trade documentation at Thomson Reuters Legal Managed Services, explores the…

Risk of no-trade lists as banks leave Brexit plans late

European clients could face bottleneck of contract transfer requests from relocating banks

Libor to become third-country benchmark under no-deal Brexit

UK-based reference rate would need to gain EU approval by end-2019 to avoid “unthinkable” disruption

EU’s further intragroup clearing relief: banks want more

Esma proposes to extend exemptions from clearing obligation but industry wants permanent solution

Brexit OTC mutation, chaperones and SA-CCR

The week on Risk.net, October 6–12, 2018

Let regulators manage no-deal risks

EU can stop swaps market falling over a Brexit cliff – and EU firms will be biggest losers if they don’t act

Stuck in traffic: EU turf war holds up CCP resolution rules

Unsuitable rules for failed banks could be used to resolve French and German clearing houses

Brexit: listed derivatives face OTC mutation

No-deal would flip EU27 users into different regime for UK-listed trades

Day one of a no-deal Brexit: swaps and chaperones

Banks, trading platforms, repositories tee up EU entities – and dread the repapering crunch that would follow

LCH cancellation notices, Eurex incentives and prop trader rules

The week on Risk.net, September 29 – October 5, 2018