Brexit

Libor to become third-country benchmark under no-deal Brexit

UK-based reference rate would need to gain EU approval by end-2019 to avoid “unthinkable” disruption

EU’s further intragroup clearing relief: banks want more

Esma proposes to extend exemptions from clearing obligation but industry wants permanent solution

Brexit OTC mutation, chaperones and SA-CCR

The week on Risk.net, October 6–12, 2018

Let regulators manage no-deal risks

EU can stop swaps market falling over a Brexit cliff – and EU firms will be biggest losers if they don’t act

Stuck in traffic: EU turf war holds up CCP resolution rules

Unsuitable rules for failed banks could be used to resolve French and German clearing houses

Brexit: listed derivatives face OTC mutation

No-deal would flip EU27 users into different regime for UK-listed trades

Day one of a no-deal Brexit: swaps and chaperones

Banks, trading platforms, repositories tee up EU entities – and dread the repapering crunch that would follow

LCH cancellation notices, Eurex incentives and prop trader rules

The week on Risk.net, September 29 – October 5, 2018

EU clients face axe from UK CCPs

But Esma’s Maijoor offers lifeline, calling for continued access for EU members

Q&A: CFTC’s Giancarlo on the race to overhaul cross-border rules

New Sef rules imminent, but deference to foreign regulators may not be completed by 2020

Dealers sour on Mifid’s systematic internaliser label

SI decisions will take account of tougher pre-trade rules, client demand and Brexit

EU may let UK insurers break law to pay clients after Brexit

Member states likely to choose protecting policy-holders over suing firms, if UK leaves with no deal

Trade finance under new stress as commodity markets realign

Higher tariffs, sanctions and Brexit are leading to a reassessment of trade finance arrangements

The foreshocks of Brexit

As Brexit chaos continues, energy firms and traders are upping sticks and leaving the UK

FIA transfer protocol sets Brexit plans in motion

Some banks set to begin transferring clients to EU affiliates next month

Brexit uncertainty for UK and Irish power markets

Traders remain in the dark about the future of the UK’s participation in the Internal Energy Market

Brexit threatens UK-based banks’ corporate repo funding

UK banks and UK bases of global banks fear losing valuable source of NSFR cash

Brexit deal talk ‘too late’ for departing brokers

Contingency plans are past point of no return, say venues

Corporates fear EU will spike Emir Refit reporting relief

Delegated reporting threatened by policy-maker objections to use of foreign banks

UK leverage ratios stray from EU measures

Bank of England changes exempt central bank claims from UK measure, causing discrepancies with CRR version

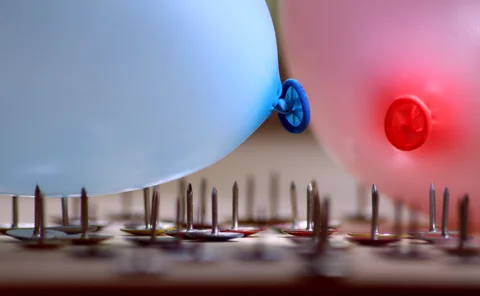

Time running out for EU Brexit temporary permissions regime

UK clearing houses may need to eject EU member positions if BoE scheme is not reciprocated by year-end

UK Treasury never analysed impact of risk weights for EU debt

Risk weight move seen as political threat to EU sovereign issuance to force Brexit equivalence deal

Kyte follows broker herd to Europe as Brexit looms

OTF provider lines up contingency plan to transfer London business to Paris entity

'No-deal' Brexit would add risk weights to EU government bonds

HSBC has most sovereign exposures that could attract higher capital charges among big UK banks