Brexit

Hedge funds eye Brexit escape from Mifid reporting

UK tipped to diverge from Europe’s proposed reforms to fund manager rules

EBA’s software compromise draws fire on two fronts

UK regulator suggests it will neuter the proposed capital relief, which banks say doesn’t go far enough

No Mifid equivalence for UK at end of Brexit transition

Footnote reveals assessment delay beyond January 2021, piling pressure on London-based firms

EU’s Brexit clearing grab slow to lift off

Clearing members say clients aren’t transferring material volumes from LCH to Eurex rapidly

‘Improving’ Mifid post-trade transparency splits markets

Mooted changes to Europe’s transparency regime are dividing markets – largely along functional lines

Attention turns to Esma after UK quashes CSDR buy-ins

Esma launched informal review just before UK Treasury opted out of settlement regime

Spot FX shies away from regulatory yoke

As Europe weighs Aussie-style rules for spot trading, some see benefits – but many fear the burden

EU ‘non-paper’ reveals new effort to delay CCP open access

Negotiations on CCP recovery and resolution could provide a route to postpone Mifid rule

Eurex seeks Hong Kong clearing licence

Bourse has Greater China in its sights after Japan and Singapore licences approved

Equivalence failure threatens European share trading

UK and EU investors may be forced to trade dozens of shares on less liquid exchanges, analysis shows

SOFR drought, CB accounts for CCPs, and the Top 10 Op Risks

The week on Risk.net, February 29–March 6, 2020

Why bankers should embrace the Brexit political theatre

Treating equivalence as purely technical might not have the outcome that financial firms want

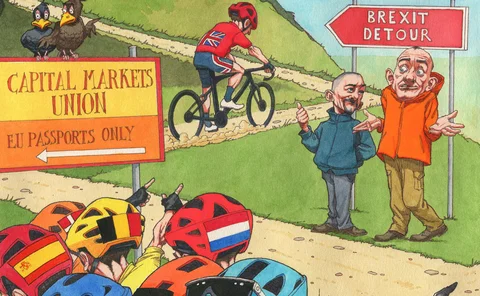

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

Top 10 operational risks for 2020

The biggest op risks for 2020, as chosen by industry practitioners

Top 10 op risks 2020: regulatory risk

New technology and reams of red tape make non-compliance fines more likely

Top 10 op risks 2020: geopolitical risk

Nationalism, trade wars and epidemics make for a heady cocktail

Top 10 op risks 2020: organisational change

New tech has created perennial state of flux in banking, as other kinds of shake-ups continue

Who killed FX volatility?

Beyond central bank policy, traders see a range of hidden structural factors at work

SA-CCR, IM relief and the fuzziness of good behaviour

The week on Risk.net, February 15–21, 2020

New Mifid equivalence rules leave UK firms in limbo

Revised market access rules won’t kick in until six months after UK leaves single market

PRA’s Woods: ending capital deductions for IT is ‘dubious’

Regulator signals potential divergence between UK and EU capital rules after Brexit transition

BNP leads a comeback for Europe’s clearers

Brexit, leverage ratio tweaks and concentration fears could help European banks compete with US FCMs

Watch out for Brexit cliff edge 2.0, experts warn

Measures to mitigate a sharp rupture for financial services could be less likely at end-2020

Esma trains beam on investment fund risks

Officials look to regulatory reporting for better grasp of fund leverage and liquidity