Algorithmic trading

Sterling flash crash leads to market price confusion

Banks set their own sterling/US dollar low 4% higher than some traded rates

HFT firm Teza said to be eyeing prop trading retreat

Big US Treasury trader has seen hedge fund add $1.5bn this year

Algorithmic execution: Harnessing technology to manage risk

Sponsored feature: HSBC

End-users debate CFTC automated trading rule

Representatives of energy and agriculture firms clash over Regulation AT

CFTC automated trading proposal worries energy firms

Companies surprised to learn they may need to register as algorithmic traders

Optimal trading trajectories for algorithmic trading

This paper derives explicit formulas for the optimal implementation shortfall trading curve with linear and nonlinear market impact.

Dealer algos strike back in swaps market showdown

Auto-quoting starting to take root as incumbents try to keep pace with Citadel

FSB’s Andresen: liquidity risks were underpriced pre-crisis

Top staffer at FSB addresses liquidity, bank risk data and securities financing risks in a wide-ranging interview

Interest rate derivatives house of the year: Citadel Securities

Swaps market outsider changes the way the game is played

Algo trading feedback loops an urgent worry, Carney warns

Some traders don't understand risks of algos, BoE says

Seeking transparency: The outlook for foreign exchange trading in Asia

Sponsored survey analysis: Thomson Reuters

US spoofing crackdown is a case of misplaced priorities

There are worse HFT practices than spoofing, yet only spoofers go to jail

China could restrict offshore program trading in Hong Kong

Cross-border co-operation agreement already exists between CSRC and Hong Kong's SFC

Investors want to know logic behind machine learning

Big data tools a hard sell without clear explanations, says Winton researcher

UK banks face 'billions more' in fines as BBA looks to future

No way to provision against US penalties, conference hears

Profile: UBS on the past and future of fixed income

Swiss bank's fixed-income trading floor is home to two distinct businesses

Horizon Software: coping with the compliance burden

Firm’s head of electronic trading says EU regulation choking options market liquidity

Forex algos revive US rates trading at UBS

Rejigged algo behind doubling in volumes - Swiss bank aims to repeat trick in swaps

Capital markets in Japan unconvinced of big data’s potential

Firms discuss ways to make better use of data glut

Profile: Citadel's Hamill on the fight for swaps market share

New entrant is making prices - and hedging - electronically

Citadel shaking up swaps competition

Chicago firm is now a top-four market-maker on US swap platforms

Fixing the cognitive problems at the root of the crisis

Decision-making failures are being tackled in three very different ways

Robot risk managers excite swap market-makers

Banks hope auto-hedging algorithms will cut costs, boost volumes

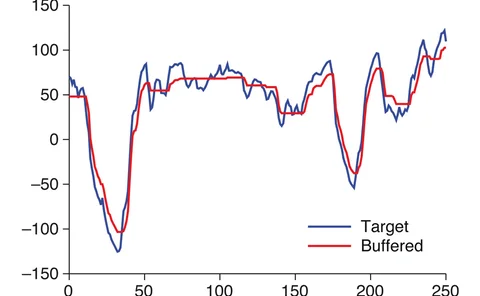

Optimal trading under proportional transaction costs

The theory of optimal trading under proportional transaction costs has been considered from a variety of perspectives. In this paper, Richard Martin shows that all results can be interpreted using a universal law through trading algorithm design