This article was paid for by a contributing third party.More Information.

Seeking transparency: The outlook for foreign exchange trading in Asia

A recent survey of the Asian foreign exchange market, conducted by Asia Risk and sponsored by Thomson Reuters, determined how increased financial regulation will affect forex traders in Asia and which major new trends or developments could have the greatest impact on the future development of this market.

The Asian foreign exchange market has faced great change in recent years, as it continues to feel the effects of regulation and of recent conduct-related scandals. Regulators throughout the region are in the process of developing new systems of rules and requirements in alignment with a global programme to increase the transparency of the world’s financial markets.

While some Asian countries are further along than others in developing a regulatory infrastructure in response to the 2008 financial crisis and the ensuing global market crisis, most financial market participants, regardless of location, remain unsure about how the dust will eventually settle. In markets such as forex reporting requirements are already in place in many jurisdictions throughout Asia, but firms still face unknowns in terms of the development and implementation of new rules relating to trading, central clearing, and capital and margin requirements.

So, as the forex market faces increasing levels of regulatory scrutiny, how will these new rules, regulations and standards affect traders in Asia? What are the major new trends or developments that are likely to have the greatest impact on the future development of the Asian forex market?

A November 2015 survey by Thomson Reuters and Asia Risk polled more than 100 forex trading organisations about a range of issues that are set to impact the market over the next 18 months or more. Participants included traders, business managers and compliance and risk management professionals at Tier 1 banks, large local banks and asset management firms, among other types of organisation. More than 50% of respondents work at firms with $20 billion or more in total assets under management and most (97.3%) operate in Asia, but also have a presence in Europe (52.2%) and in North America (41.6%).

Major findings from the survey include:

- 66.4% of respondents have no concerns about unintended consequences relating to transparency and liquidity arising as a result of current regulatory changes in the Asian forex markets.

- 78.1% expect regulators to follow the model of transparency created for the equities markets when designing a best execution regime for forex trading.

- 69.5% of organisations polled already use electronic platforms to trade forex and 19.5% are considering the use of such venues in the next 18 months or more.

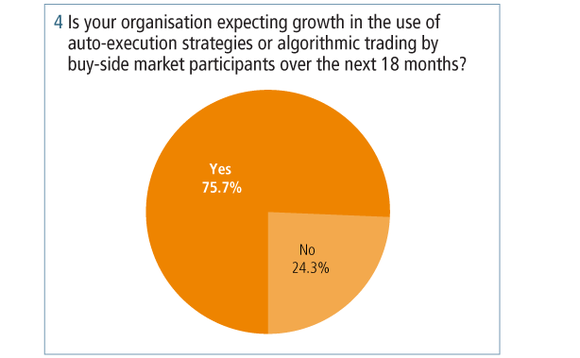

- 75.7% of respondents believe more buy-side market participants will start to use auto-execution or algorithmic trading as part of their forex strategies over the next 18 months.

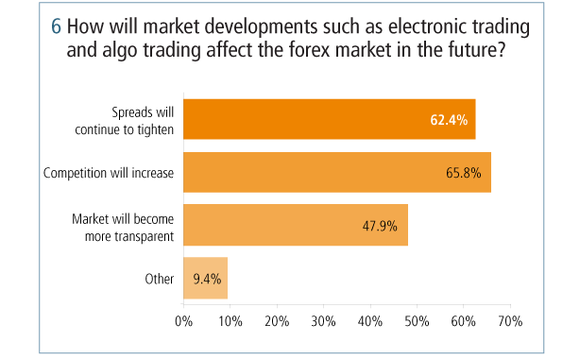

- 62.4% of forex market participants believe electronic and algorithmic trading will cause spreads to continue to tighten in the forex market, while 65.8% think it will increase competition.

- 47.9% say these technological developments will directly result in greater transparency.

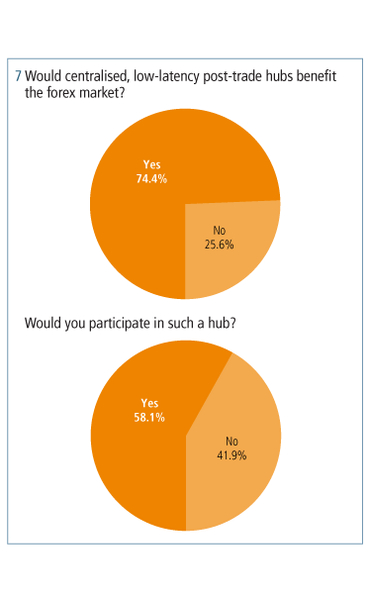

- 74.4% believe the forex market would benefit from centralised, low-latency post-trade hubs, and 58.1% would use such a hub.

- In terms of future currency trends, more than 50% of respondents think the USD/CNY currency pair will see the most growth over the next 18 months.

- 58.2% have seen some degree of change to their business operations as a result of RMB internationalisation.

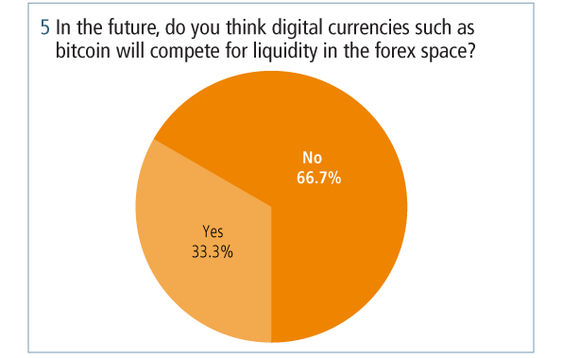

- 66.7% do not believe digital currencies will compete for liquidity in the forex space in the future.

As the results of the survey show, market participants are generally positive about many of the changes that are likely to come about in the sector over the period as a result of regulatory developments and new technology. When it comes to pricing, trading activity, regulation and innovation, respondents believe the market will be affected in a variety of ways in relation to transparency and liquidity. These changes are likely to spur technological innovation as the forex market learns from other parts of the financial services sector that have already been affected by similar regulatory and market change, and positions itself to fully address the changing needs of both regulators and investors.

The route to transparency

Following the global financial market crisis in 2008, the leaders of the Group of 20 (G20) nations came together in Pittsburgh, USA, in September 2009 to map out a way forward that would support a global recovery and ensure avoiding another financial crisis of such magnitude. The commitment made to reform over-the-counter (OTC) derivatives trading as a result of that 2009 meeting has reverberated throughout the global financial markets ever since. The agreement was based on the need for greater transparency and for measures to protect against systemic risk and prevent market abuse. Four main areas of reform were agreed upon to meet these aims: mandated trade reporting; central clearing of standardised contracts; a move from bilateral to exchange-based trading (where possible); and increased capital and margin requirements for those contracts that are not centrally cleared.

The Financial Stability Board’s (FSB) most recent review of jurisdictional progress in relation to financial regulation – OTC derivatives market reforms: Tenth progress report on implementation, published on November 4, 2015 – shows that 19 of the 24 regulators that are in FSB jurisdictions have already put reporting requirements in place that cover more than 90% of transactions, half have implemented central clearing frameworks, eight jurisdictions have so far replaced bilateral trading with organised trading platforms, and most are also beginning to implement margin requirements for non-centrally cleared derivatives.

More specifically, FSB member jurisdictions in Asia have made progress in putting trade reporting requirements in place for some asset classes, including forex, according to the FSB report. Hong Kong has established reporting measures currently in place for certain subsections of forex and interest rate transactions, while Japan, India, Indonesia, Korea and Singapore have trade reporting requirements in place for all transactions in both asset classes. Some jurisdictions in the region have also extended these requirements further, to sectors such as credit and equities.

However, problems remain across the global financial services sector when it comes to trade reporting. According to the report, there are legal and regulatory barriers to reporting, as well as impediments to authorities’ access to trade repository data. There are also a number of challenges in terms of the quality and usability of trade repository data, according to the FSB, although it says this is being tackled at a national and at an international level.

In a statement on the publication of the report, Ravi Menon, chairman of the FSB’s Standing Committee on Standards Implementation, said: “Trade reporting is a core part of the reform agenda for OTC derivatives markets. We have made good progress in implementing trade reporting requirements. But to fully realise the potential of trade reporting to improve market transparency, mitigate systemic risk and minimise opportunities for market abuse, further efforts are needed by all stakeholders – authorities, trade repositories and market participants – to close the remaining gaps.”

Gauging the market

While the implementation of new rules addressing the four main areas of financial regulation has had – and will continue to have – a major impact on forex trading, as the FSB’s Menon points out, trade reporting is key to developing the necessary level of market transparency under the current regulatory regime. As such, perhaps one of the most direct impacts of these new regulations on market participants so far has been the increased compliance burden arising from requirements in areas such as reporting and the resulting need to manage greater volumes of data efficiently and effectively on a daily basis.

There is a clear need for regulated entities to invest time, money and people to address these issues and to develop the necessary systems and processes to remain on the right side of regulation. As a result, there has been a marked drive for, and an expectation of, increased transparency among market participants.

Looking at the forex market in Asia in particular, two-thirds (66.4%) of respondents to the survey are not concerned about unintended consequences relating to transparency and liquidity arising as a result of current regulatory changes in this part of the Asian financial sector (figure 1).

This level of confidence in the regulations is interesting and may be due to the progress made in other markets and different jurisdictions – market participants have watched the regulatory infrastructure evolve elsewhere and are comfortable with the results so far. For example, nearly 80% of respondents to the survey expect regulators to follow the model of transparency created for the equities markets when it comes to designing a best execution regime for forex trading (figure 2). This indicates that the equities market is being viewed almost as a pilot or a model for other markets such as forex trading that are due to face similar changes in this area. Best execution is a key element of the systems of financial regulation that are currently being rolled out throughout the global markets. The aim of regulators in this area is not only to protect clients and investors, but also to safeguard the price formation process and ensure the necessary level of competition among trading venues. As such, a strong approach to best execution is needed to provide the level of transparency that market participants seem to expect, according to the survey.

Increased regulation and the desire for greater transparency through measures such as best execution have also encouraged firms in the sector to be more open-minded or welcoming towards new or evolving technology such as electronic platforms and algorithmic trading. Regulatory change, such as that currently faced by the forex market, typically results in a need for new or evolving forms of technology in order to help financial firms meet compliance demands more efficiently and cost-effectively. For example, the survey shows that 69.5% of respondents work at organisations that already use electronic platforms to trade forex, with nearly 20% more considering the use of such venues in the next 18 months or more (figure 3). Around three-quarters (75.7%) of respondents also predict that more buy-side market participants will start to use auto-execution or algorithmic trading as part of their forex strategies over the next 18 months (figure 4). These tools allow organisations to manage and respond to certain trading risks on a real-time basis, for example, by using analytics to assess and hedge positions as necessary. This allows organisations to remain within the bounds of regulation, and also to successfully and profitably transact in a cost-effective manner.

In addition to current technological developments and solutions aimed directly at regulatory issues, banks are also keen to draw inspiration from other sources. Cryptocurrencies such as bitcoin have the potential to change the currency trading markets and the wider financial services industry in general via the underlying technology behind these digital currencies. The survey shows that organisations in the sector generally do not see bitcoin or other forms of cryptocurrency as a threat – nearly 70% of participants in the survey do not believe digital currencies will compete for liquidity in the forex space in the future (figure 5). However, the blockchain technology that facilitates bitcoin transactions has started to pique the interest of banks throughout the financial services sector. The blockchain is essentially a public ledger that records any and all bitcoin transactions. As such, there are obvious applications for financial services that banks have already started to explore in terms of transferring funds internally and recording transactional information in a faster and more cost-effective manner. For banks that are experiencing the strain of antiquated technology systems at a time of more onerous regulation that is particularly focused on reporting and record-keeping, the blockchain presents many attractive possibilities.

The effect of technology

This onslaught of regulatory change, and the adoption of new or evolving forms of technology to manage and even profit from the subsequent changes, is likely to result in a number of market developments, according to forex trading professionals who participated in the survey. In addition to tightened spreads, market-takers should also see more competitive pricing for the transactions they wish to conduct, thanks to a new level of transparency throughout the global financial markets. Indeed, according to the survey, forex market participants believe developments such as electronic trading and algo trading will cause spreads to continue to tighten (62.4%) and will also increase competition (65.8%) in the market. A further 47.9% say that the technological developments that are currently happening in the market will directly result in greater transparency (figure 6).

When it comes to post-trade processing, the survey reveals there is also a need for better solutions. According to the results, almost three-quarters of respondents (74.4%) believe that the forex market would benefit from centralised, low-latency post-trade hubs, and more than half (58.1%) would participate in such a hub (figure 7). Such services offer a single platform for organisations to perform capture, routing and processing activities across numerous trading locations. This simplifies operational needs and cuts costs because multiple systems can be integrated across the organisation to provide whatever post-transactional data is necessary for internal risk systems, and to satisfy regulators and clients.

Currencies outlook

Currencies outlook

In addition to regulatory concerns and expectations, the survey polled forex market participants about other important issues that are likely to affect the Asian forex market in the near future. According to the participants, USD/CNY is the currency pair that will see most growth over the next 18 months. Out of a list of 13 possibilities, more than 50% of respondents chose this pair, compared to the second most popular option of USD/JPY at 15.5%, followed by EUR/JPY at 6% and USD/CNH with only 5.2% of the vote (figure 8). The huge difference between the top pick and the subsequent choices shows the great deal of support and confidence that exists in the market for RMB internationalisation in the Chinese currency.

In fact, many organisations have already felt the effects on their business of the internationalisation of RMB to some extent. Nearly 60% of those polled say there has been some degree of change as a result (figure 9). Some of those respondents who went into more detail, saying they have seen “more business”, “more opportunities” and “more products” because of RMB internationalisation. One individual said “we are getting more requests from clients to make RMB pairs available for trading”, while another added that their organisation now includes some RMB strategies in its fixed-interest portfolios. Indeed, according to the latest figures from the Society for Worldwide Interbank Financial Telecommunication (Swift), RMB was the fifth most active currency for global payments by value in October 2015, accounting for 1.92%. Between Japan and China/Hong Kong, RMB is now the second most active currency after the yen, Swift says, rising from 3% of payments by value in 2012 to 7% by October 2015. Institutional transfers, which represented 97% of total payments value during that month, were a major factor behind increased RMB use in this area. This supports the evidence in the survey that market participants have seen changes in relation to the impact of RMB internationalisation on their businesses in recent years.

The way forward

Change remains firmly on the horizon for the financial services industry as global regulators continue to roll out complex programmes of new rules. But, as this survey shows, forex market participants are willing to explore new options, such as electronic trading (19.5%) or the use of centralised, low-latency post-trade hubs (58.1%), which will allow them to adapt in response to these external events.

While some concerns about issues such as liquidity remain among one-third of respondents (figure 1, at top of article), organisations in this sector seem keen to try new forms of technology such as algorithmic trading or auto-execution (75.7%), using such innovations to figure out how to comply with new rules, and also remain as efficient and competitive as possible even as market structures continue to change.

The transparency that regulators hope to instil in the global financial markets should lead to better trading conditions. As participants continue to explore the use of new platforms, trading strategies and IT systems and processes, this regulatory goal of transparency remains well within reach. Forex market participants have already started to anticipate how new rules are likely to be written and implemented, and have begun to explore the tools that can be used to comply, as well as the potential results for the market in the short term and over a longer-term basis. Forex organisations must connect with vendors and other third parties that can provide the necessary assistance, advice and access to innovative tools, in order to face this new era of regulatory change and technological innovation with confidence.

Read/download the article in PDF format

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net