Energy Risk

How to be top of the class

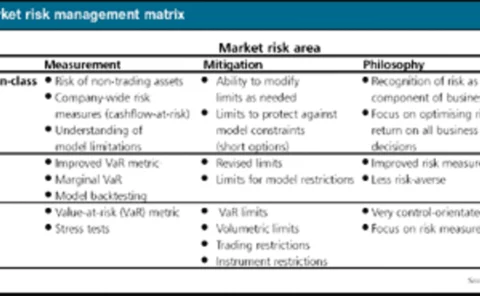

Brett Humphreys discusses the attributes that combine to create a best-in-class market risk management division within an energy company

Correction – Allegro: The following text should have been included in the software vendor directory in last month’s (July) issue.

Allegro Development has provided energy firms with transaction and risk management software solutions for almost 20 years. Founded in 1984, Allegro provides an industry-leading set of customisable energy software components for companies including…

The derivatives burden

Exchanges

Gas hubs jockey for position

Exchanges

Joining up the markets

Exchanges

Warming to the exchanges

Exchanges

US coal trading picks up steam

While the coal market awaits pricing indexes to reinvigorate trading, emissions trading is getting a boost from increased coal burning. Catherine Lacoursière reports

A secure base

Long praised as pioneers in the energy derivatives space, US energy firms are now looking to make their overall risk management practices more robust. And, as Paul Lyon discovers, these companies have several innovations up their sleeves, such as…

Backwardation and contango change indicators for seasonal commodities

In the first part of this two-part article, Svetlana Borovkova introduced two indicators for detecting changes between backwardation and contango market states. Here, in the second part, she applies the indicators to seasonal commodities and introduces a…

S&P to apply stress test to power firms

Standard & Poor’s (S&P) is to apply a stress test designed to measure how well power companies can stand price swings in volatile electricity markets. The move is part of the credit rating agency’s effort to combat criticism of rating agency failure to…

The trouble with normalisation

Weather derivatives practitioners say normalisation agreements between regulators and utilities in the US are posing a threat to their industry. Kevin Foster investigates

Vince Kaminski

Vince Kaminski has returned home – both to his home town of Houston, and to an asset-based energy company – after a year with financial trader Citadel Investments in Chicago.

Oil prices cause ripples in chemicals market

The chemicals market has been hit by the effects of high oil prices. Higher feedstock prices have brought higher end-product prices. Fame Information Services looks at styrene prices and the soaring costs of feedstocks, particularly in the ethylene market

Emerging adequacy

The Committee of Chief Risk Officers’ capital adequacy ‘emerging practice’ guidelines will, says the capital adequacy committee chair, evolve into a new regulatory body within a year. James Ockenden reports

People swaps

SG reshuffles project finance and utilities divisions SG Corporate & Investment Banking, a subsidiary of Société Générale, has named Matthew Vickerstaff and Roger Bredder as the respective heads of project finance for Europe and the Americas. London…

US pushes agreement on carbon storage research

The US government has launched an international research and development programme to reduce power plant emissions by pumping carbon dioxide (CO2) into deep storage.

LNG may not fix gas supply problem

Despite its long-term promise, liquified natural gas (LNG) will only have a minimal impact on a significant US gas storage shortfall in the winter of 2003/2004, says Energy Security Analysis Inc (Esai), a Boston-based research firm.

Icap shuts London weather desk

Inter-dealer broker Icap exited the European weather and environmental derivatives market last month. It thereby joined the growing ranks of other market participants – including BNP Paribas, Aquila and Italian bank Intesa BCI – that have fled the…

Ferc executes already dead Enron

Enron became the first company to face the Federal Energy Regulatory Commission’s (Ferc) “death penalty” in June when the US energy regulator revoked the bankrupt firm’s authority to sell electricity at market-based rates.

Ferc’s California clean-up

Sixty energy firms and utilities will have to justify their activities during the California energy crisis, the Federal Energy Regulatory Commission (Ferc) said in its regular bi-weekly meeting on June 25.

Mirant raises prospect of bankruptcy

Energy company Mirant asked its bank lenders to approve a pre-packaged bankruptcy plan in June, suggesting the Atlanta-based company could be forced to file for Chapter 11 bankruptcy.

Lessons in loaning

Lenders and borrowers alike are becoming ever more innovative at a worrying time for energy company financing. But will the new ideas catch on? Paul Lyon reports

More power to the banks

Banks now have greater freedom to participate in derivatives markets based on physical commodities thanks to two recent ruling by US regulators. As a result, the balance of power looks set to shift from Houston to New York. By Paul Lyon

California’s master plan

California’s energy regulators have an action plan to upgrade the electricity system. But if they don’t add generation, shortages could again hit. Kevin Foster reports