Energy Risk

System-ready for Sarbanes-Oxley

Energy companies are not alone in having to review their operations to comply with the Sarbanes-Oxley Act. Energy software suppliers, too, are looking at their systems, although most are confident they are already well prepared, finds Clive Davidson

A hard Act to follow

The final piece of the Sarbanes-Oxley Act – section 404 – falls into place this month, requiring internal control reports. While the Act may go some way to restoring investor confidence, it is costing energy companies dear, finds Kevin Foster

Water faces rising costs

UK water utilities are expecting rising electricity and environmental costs as they and their regulator prepare for the next five-year price review. Maria Kielmas reports

Taiwan’s growing risk appetite

Relying on imports for most of its energy requirements and constrained by the government’s view that risk management is gambling, how can Taiwan tackle the challenge of price risk in its growing energy sector? By David Hayes

Watching the home front

The growing international controversy about Iran’s nuclear ambitions as well as internal unrest may stall foreign investment in the country’s energy sector in a way that US sanctions have failed to do. Maria Kielmas reports

People swaps

BOC’s Mortimer to join European energy users’ body Hugh Mortimer, commercial manager at UK industrial group BOC, has been invited to join the board of the International Federation of Industrial Energy Consumers Europe (IFIEC). He will replace David…

Chicago Climate Exchange live in Octoberwith contract sale

The Chicago Climate Exchange (CCX), a greenhouse gas (GHG) emissions market, will start trading on October 10, it said in August. CCX also said it has contracted Atlanta-based online commodities exchange IntercontinentalExchange (Ice) to design, provide…

Allegheny reduces trading exposure with contract sale

Maryland-based Allegheny Energy has reduced its exposure to energy trading by selling an energy supply contract to a subsidiary of Goldman Sachs for $405 million.

Hedge out on the highway

US haulage firms seem to be making little use of risk management tools to mitigate high fuel prices. But parcel carriers are taking the initiative, finds Kevin Foster

Isda and EEI collaborate on Power Annex

The New York-based International Swaps and Derivatives Association (Isda) and US trade body the Edison Electric Institute (EEI) published a North American Power Annex to the Isda Master Agreement in August.

Both sides of the fence: a statistical and regulatory view of electricity risk

Ernst Eberlein and Gerhard Stahl analyse price series of 25 energy spot rates simultaneously using Lévy models. This model class allows the capture of stochastic behaviour of these financial instruments. The implications of this analysis will form the…

In search of power solutions

Blackouts across Italy in early July highlight the need for power plant investment – and the new market operator says promotion of derivatives trading is necessary to encourage such investment. But producers are yet to bite, finds James Ockenden

Valuing exploration and production projects

Lukens Energy Group’s Hugh Li sets out an option method for valuing exploration and production projects, using a practical example

Management buys out SG’s weather and cat bond funds

Société Générale’s (SG) weather derivatives team completed an amicable management buyout of the weather division at the French bank. The buyout creates what is believed to be the largest range of dedicated weather derivative and catastrophe bond funds,…

Austrian rail firm on the risk management fast track

Austria’s largest electricity consumer, rail firm Österreichische Bundesbahnen, talks to EPRM about its energy risk management strategy. And, as Paul Lyon discovers, other end-users could learn from the innovative company

LNG not a short-term supply fix, warns US research firm

Liquified natural gas (LNG) will have a minimal impact on a significant US gas storage shortfall in the winter of 2003/2004, despite its long-term promise, says Energy Security Analysis Inc (Esai), a Boston-based research firm.

A capital adequacy primer

A summary of the Committee of Chief Risk Officers’ (CCRO) emerging guidelines on capital adequacy, by Cinergy’s Antonio Ligeralde, Kenneth Robinson of El Paso Merchant Energy and CCRO head Michael Smith

Mirant bankruptcy is not terminal

US energy firm Mirant’s July bankruptcy filing bucks the recent trend of last-minute restructuring deals that have saved many of its rivals from a similar fate. But analysts say the company is likely to emerge from its filing with at least some of its…

People Swaps

ABN Amro hires global energy trading head Dutch bank ABN Amro has hired Jonathan Arginteanu to the newly created positionof senior vice-president and deputy head of global energy trading operationsin New York. He was previously head of rival bank BNP…

From a gas crunch to a crisis

In this month’s Market Focus, GlobalView Software takes a look at the factors contributing to the current US natural gas crunch, which is drawing the attention of major political and financial figures

UK energy brokers form association

Nine brokers operating in the over-the-counter energy markets in the UK formed the London Energy Brokers’ Association (LEBA) in July.

The search for spot

Strong demand for US liquefied natural gas is accelerating the development of an active global spot market and pricing benchmarks, as Catherine Lacoursière discovers

Vincent Annunziata

During his time as a senior commodities trader and risk analyst, Vincent Annunziata noticed an alarming trend: like any other trading outfit, his company was prone to human error. He was working for Phibro – formerly the commodities trading division of…

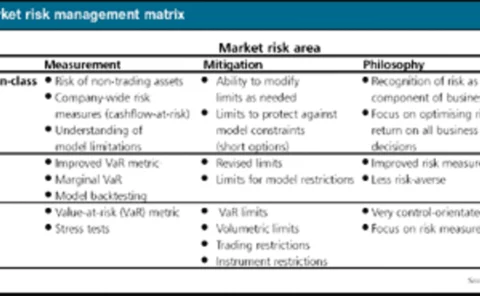

How to be top of the class

Brett Humphreys discusses the attributes that combine to create a best-in-class market risk management division within an energy company