Energy Risk

Eyeing the pricing

Natural Gas

Profiting from gas prices

Natural Gas

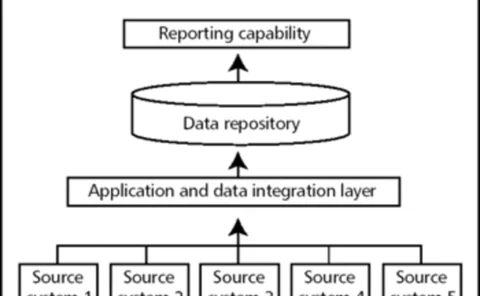

Getting it together

Data consolidation is now a vital foundation to any successful risk management implementation, as Dave Rose and Stuart Cook of The Structure Group report

Farms weather power shortages

Farmers in both hemispheres are struggling to cope with heat waves and droughts while pondering the prospect of future power supply disruptions, finds Maria Kielmas

Enron files complaint against six of its former banks

Houston-based Enron last month filed a court complaint against six of its former banks, claiming they gave bad financial advice that contributed to its demise in late 2001. As a bankrupt company, Enron is required to try to recover as much as it can for…

Switching off to save cash

High electricity price volatility over the European summer has raised awareness of interruptible power contracts, finds James Ockenden

US body calls for electricity reliability organisation

The Edison Electric Institute (EEI) says the creation of an electricity reliability organisation with regulatory oversight is vital for developing and enforcing mandatory reliability rules and standards for US power sector participants.

Pieter Verberne

Pieter Verberne, Amsterdam PowerExchange’s (APX) chief operatingofficer, is a busy man. The Dutchexchange is finalising the technologyupgrading of its recent acquisitions, naturalgas exchange Enmo and Automated PowerExchange, both based in the UK. It is…

Barrier to entry

Bank of America and UBS are still trying to overcome obstacles that could prevent them entering physical power trading in the US. Federal Energy Regulatory Commission regulations represent the biggest obstacle. Paul Lyon reports

Chicago Mercantile Exchange to list European weather contracts

The Chicago Mercantile Exchange (CME) has started offering European weather derivatives, referenced on five cities’ temperatures.

Calpine completes project financing in Wisconsin

California power company Calpine Corp has completed a $230 million non-recourse project financing for its 600-megawatt (MW) gas-fuelled electricity-generating Riverside Energy Center in Beloit, Wisconsin.

Breaking down the model

Brett Humphreys and Andy Dunn outline a method to help energy companies minimise potential model risk and thereby avoid costly errors in valuing deals

Power to the European gas markets

Natural Gas

US gas squeeze hits power

Natural Gas

Gas supply problems persist

Natural Gas

To store or not to store

Natural Gas

All talk, no action

Cancelled power plant auctions and the complexities of asset debt structures are bad news for the boutiques set up to acquire power assets. The boutiques talk a good business plan – but execution may prove troublesome, as Paul Lyon discovers

Tennessee’s valley of debt

Tennessee Valley Authority’s power plant financing arrangements should be measured as debt, says the US General Accounting Office, thereby putting further pressure on its politically sensitive and federally restricted debt levels. Paul Lyon reports

LNG could rescue the US

Sandy Fielden of energy market specialist Logical Information Machines looks at a potential solution to the US natural gas supply crisis: liquefied natural gas

WRMA to campaign on data and against normalisation

Lynda Clemmons, president of the US Weather Risk Management Association (WRMA), is to sit on an American Meteorological Society (AMS) panel to address issues in the weather industry involving weather data and public-private partnerships.

A true test for value-at-risk

The three classic approaches for measuring portfolio value-at-risk do not compare like with like, argues Richard Sage. Here he presents a test portfolio to highlight the differences between calculation methods

Royal Bank of Canada reaches agreement over Enron case

The Royal Bank of Canada (RBC) has reached a settlement agreement with Enron, the Enron creditors’ committee and Dutch firm Rabobank, resolving aspects of a share transaction known as ‘Cerberus’. The transaction also involved the use of total return…

Utilities cut spending on IT

Energy utilities have cut spending on IT by 13% so far this year, according to the initial results of a study by Connecticut-based consultancy the Meta Group.

Deregulation versus re-regulation

While the US authorities are still ironing kinks out of a major electricity market redesign and looking to repeal the utility industry’s most influential Act, US regulators and self regulators are moving to fill the vacuum. Catherine Lacoursière reports