Strategy

CTAs beat hedge fund rivals in 2014

Investors hope that CTAs’ fortunes have changed for good

A promising future

Sponsored statement: NYSE Liffe

Government bond traders see difficult markets heading into 2014

Your word is my bond

Hedge funds increase Asia quant investing risk capital by 50%

An improved Japan economy is ramping up quant investor activity across Asia

CTA trend followers suffer in market dominated by intervention

Return to normality

36 South warns of consequences of asset price inflation

Squeezing the balloon

Securitised credit tops profitability league for hedge funds

Performance and asset flows of securitised credit products have combined to make this group one of the most profitable for investors and hedge fund managers. But there are now signs of waning interest

Less correlation gives stock-pickers opportunity to generate alpha

Decoupling correlations

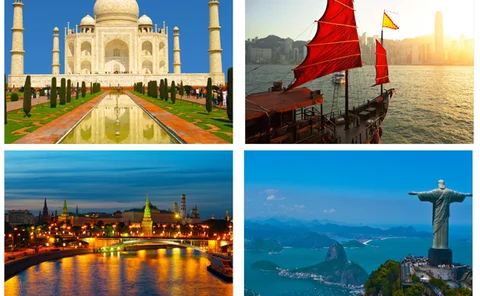

India-focused hedge funds continue seesaw performance

Mena funds outperform EM peers

EM sell-off a buying opportunity, says Ada

Changing times

Hedge funds tread carefully around Detroit bankruptcy

Unsettling bankruptcy opportunities

Campbell opens non-trend programs to investors

CTA Campbell & Company’s Prism portfolio of non-trend strategies has generated strong returns since it launched as a standalone investment in April

Distressed hedge funds on course for bumper year

Performance drops for China and LatAm-focused funds

Mortgage hedge funds refine focus after bumper 2012

Finer focus needed

Performance pick-up for equity long/short

Equity long/short regains its glamour

Natural gas market tempts hedge funds

Filling up

Japan-focused hedge funds show strong gains in first quarter

Japan-focused hedge funds surprise investors with continued strong performance as Russia also produces better returns than normal. Securitised credit still strong favourite but returns segmented

Falling correlations could give hedge funds bumper returns

A fall in asset-to-asset correlations could mean a good year for many hedge fund strategies, even though volatility is expected to remain relatively low, according to research from Axioma

Hedge fund Everest Capital heads for the frontier

Inefficient frontiers

CTAs eye swap futures

Future of managed futures