United States

FCMs’ required client margin up 29% in 2019

Citi still far and away the largest FCM

BNP leads a comeback for Europe’s clearers

Brexit, leverage ratio tweaks and concentration fears could help European banks compete with US FCMs

US banks anticipate fresh guidance on resolution liquidity

Consultation in first half of 2020 expected to clarify intra-group and forecasting requirements

CCAR more severe than EU stress tests

Real GDP decline greater for US banks under Fed tests than for EU firms grilled by the EBA

Quant Guide 2020: programmes tap banks for teaching talent

Unis are adding machine learning and data science courses, but need instructors to teach them

Fed’s stress tests to gauge banks’ leveraged loan risks

CLOs to suffer “severe corrections” under 2020 scenario

Isda plans February rerun of Libor pre-death trigger poll

Lack of consensus would add pre-cessation option to post-cessation protocol for bilateral swaps

Quant Guide 2020: Princeton University

Princeton, New Jersey, US

Quant Guide 2020: Johns Hopkins University

Baltimore, Maryland, US

Quant Guide 2020: University of Illinois at Urbana-Champaign

Urbana and Champaign, Illinois, US

Quant Guide 2020: University of Washington

Seattle, US

Quant Guide 2020: Stony Brook University

Brookhaven, New York, US

Quant Guide 2020: Rutgers University

Piscataway, New Jersey, US

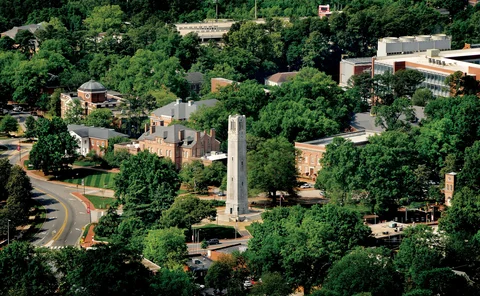

Quant Guide 2020: North Carolina State University

Raleigh, North Carolina, US

Quant Guide 2020: Cornell University

Ithaca and New York City, New York, US

Quant Guide 2020: Carnegie Mellon University

Pittsburgh and New York City, US

Quant Guide 2020: Fordham University

New York City, US

Quant Guide 2020: New York University (Tandon School of Engineering)

New York City, US

Quant Guide 2020: Baruch College, City University of New York

New York City, US

Quant Guide 2020: Boston University (Questrom School of Business)

Boston, Massachusetts, US