United States

US Bancorp trimmed toxic assets in Q4

Non-performing asset rate falls to 0.28%

At Goldman Sachs, loan-loss provisions top $1bn

Loans up 11% in 2019, but provisions for credit losses surge 59%

Stress buffer will not upend Citi’s capital plans

CET1 capital at lowest level since Q3 2013

Legal woes dent Wells Fargo’s earnings

Of total operational losses in Q4, legal costs accounted for 79%

JP Morgan takes $2.7bn capital hit from CECL

Credit card portfolios see allowances for loan losses spike the most

When a lapse in concentration is no bad thing

Fortifying too-big-to-fail firms to withstand future crises could make the entire system more vulnerable

Fed’s rush to complete stress buffer likely to unnerve banks

Quarles wants to include it in 2020 CCAR cycle, making bank capital planning difficult

At CME, required IM up 18% in Q3

Surge follows busy August and September for the swaps clearing business

OCC member default fund contributions up $1bn in Q3

Peak initial margin call was $9.9 billion in Q3

Top 10 operational risk losses of 2019

Fraud, embezzlement, tax evasion, subprime (still) and rogue trading – and Citi crops up twice. Data by ORX News

Loosening ties, pt 2: how US G-Sibs cut intra-system liabilities

Citi and Goldman expelled huge amounts of deposits in Q4 2017

Outsourced model validation: is it viable?

Consortium promises cost savings in outsourcing model validation, but some say pooling doesn’t float

How US G-Sibs shrink down at year-end

Derivatives exposure reductions make up bulk of year-end savings

Risk weight tweak could fix IFRS 9 capital clash – research

Practitioner suggests way to cancel out double-counting of Basel credit loss provisions

Ready or not – a low-carbon economy is coming

Government and business must avert disorderly move away from fossil fuels, says Geneva Association’s Maryam Golnaraghi

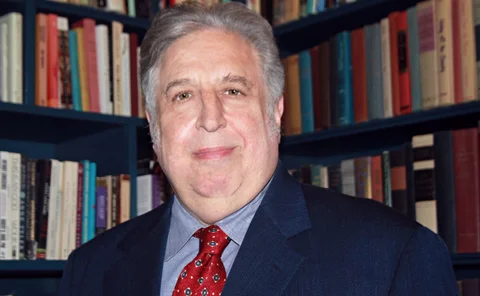

A new leaf: why a hedge fund manager bought a bank

Andy Redleaf founded a $6 billion hedge fund. Now he runs a small community bank

Loosening ties, pt 1: how US G-Sibs cut intra-system assets

Goldman Sachs reduced links with other financial firms the most in Q4 2018

Quant funds look to AI to master correlations

Machine learning shows promise in grouping assets better, predicting regime shifts

First Ibor versus SOFR cross-currency swap trades

Westpac and Citi strike BBSW/SOFR trade in landmark moment for Australian market

Sonia users push for official in-arrears rate

US Fed proposal for compounded SOFR index leads to calls for endorsement of NatWest’s Sonia calculation

In the US, it’s an even ‘tougher legacy’ for Libor

A legislative solution for cash products is in the works, but lawyers say it raises constitutional issues

US firms must rerun non-cleared margin test in March

Proposed CFTC calculation delay offers in-scope firms chance to trade out of phase five compliance

Squeezed or saved? Market divided over year-end repo stress

Fears of a cash-crunch hang heavy despite Fed’s repo giveaway and move to term funding

G-Sibs in US grow leverage exposures faster than EU rivals

HSBC saw exposures fall 2.81% in Q3