Value-at-risk (VAR)

Project risk: improving Monte Carlo value-at-risk

Cashflows from projects and other structured deals can be as complicated as we are willing to allow, but the complexities of Monte Carlo project modelling need not complicate value-at-risk calculation. Here, Andrew Klinger imports least-squares valuation…

Basel's CDO solution

As the Basel Committee on Banking Supervision continues its stately progress towards a revised capital Accord, one area remains under debate: the proposed capital rules for asset securitisations.

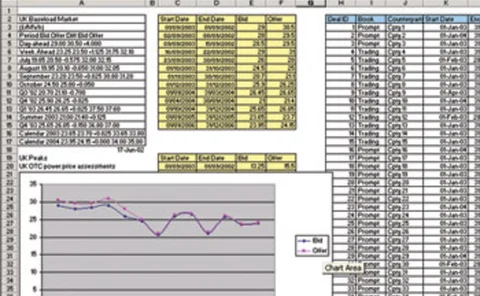

Margin notes

Brett Humphreys explains how to measure and manage margin risk, an often-overlooked – yet often-significant – risk exposure

Waiting for guidance

South Korea's banks have made huge strides in implementing risk management systems over the past few years, but Basel II is not yet a driving force, with banks waiting for the Korean regulator to publish local guidelines.

Risk management based on stochastic volatility

Risk management approaches that do not incorporate randomly changing volatility tend to under- or overestimate the risk, depending on current market conditions. We show how some popular stochastic volatility models in combination with the hyperbolic…

Fitch upgrades OpVar tool for operational risk

Fitch Ratings has added a range of new services to its OpVar software suite, an operational risk management quantification tool. Version 5.0, scheduled for release in March, now offers an enhanced data collection module and improved data management…

Extreme forex moves

What is the appropriate statistical description of tail risk in a market portfolio? In the context offoreign exchange, Peter Blum and Michel Dacorogna address this problem using extreme valuetheory. Using 20 years of data, they estimate parameters for an…

Enough’s enough

Brett Humphreys takes the guesswork out of determining how many simulations are needed to calculate value-at-risk

Getting stressed

To understand how much value can be lost from a position in the energy markets, we need to use measures other than value-at-risk. Brett Humphreys discusses methods for creating effective stress tests

Enterprise-wide risk management: Knitting together bank risks

Thanks to recent events, bank risk managers are placing more emphasis on integrating counterparty and credit risk into other portions of their enterprise-wide risk management systems.

Unsystematic credit risk

Although Basel has shifted its treatment of unsystematic credit risk from the first, capital rules pillar (where it was called the 'granularity adjustment') to the second, supervisory pillar of the forthcoming Accord, this issue is of great practical…

VAR “not to blame” for 1998 crisis, says leading academic

“There is no evidence to support the assertion that VAR-based risk management systems destabilise the financial system,” says University of California at Irvine professor Philippe Jorion, in a paper just published in the fall 2002 edition of The Journal…

Unsystematic credit risk

Although Basel has shifted its treatment of unsystematic credit risk from the first, capital rules pillar (where it was called the ‘granularity adjustment’) to the second, supervisory pillar of the forthcoming Accord, this issue is of great practical…

Reaping integration rewards

In the October issue of Risk, Clive Davidson discussed the integration of ALM and ERM technology. Here, in a second article, he profiles the firms that have tackled this project and reviews the challenges, advantages and pitfalls of the integration…

Fallacies about the effects of market risk management systems

This paper takes another look at allegations that risk management systems have contributed to increased volatility in financial markets, with the particular example of the summer of 1998. The paper also provides new evidence on the potential effect of…

A bootstrap back-test

Back-testing

Var too far

The energy industry has shown tremendous commitment to value-at-risk (Var) methodologies. But use of Var has been misguided, as James Ockenden discovers

VAR you can rely on

Analytical and simulation-based methods often appear as rivals, but many real world problems are best served by judicious combinations of both approaches. In a first of a pair of computationally themed papers, Rabi De and Tanya Tamarchenko present a…

Risk and probability measures

Although its drawbacks are well known, VAR has become institutionalised as the market risk measure of choice among trading firms and regulators. Now there is a growing feeling that a reappraisal is overdue, exemplified here by Phelim Boyle, Tak Kuen Siu…

The maturity effect on credit risk capital

In a mark-to-market approach to credit risk capital, ratings or spread volatility has the effect of making longer-maturity loans more capital-intensive. This is incorporated in the current Basel II proposals via a maturity adjustment factor. Arguing that…

Testing assumptions

In calculating value-at-risk forecasts for trading portfolios, distributional assumptions are asimportant as the choice of risk factors, but it is not easy to determine the source of errorwhen rejected forecasts occur. Here, Jeremy Berkowitz develops a…