Value-at-risk (VAR)

Building scenarios

Kenji Fujii of UFJ Holdings looks at the benefits of using scenario analysis as a means of managing operational risk, and discusses UFJ Bank's scenario-based advanced measurement approach.

Sensible and efficient capital allocation for credit portfolios

Michael Kalkbrener, Hans Lotter and Ludger Overbeck construct a new approach to economiccapital allocation, showing that three axioms uniquely determine a capital allocation scheme,and, more importantly, that any allocation satisfying the axioms is…

Sponsor's article > Credit risk catches up

When Basel II was first proposed in 1999, credit risk models lagged way behind market risk models. But that's changed, which means we need less prescriptive rules for determining credit risk capital.

Understanding the expected loss debate

The final draft of the new global Accord on bank regulatory capital – Basel II – has been delayed. A critical and unresolved issue is whether banks should include expected losses in their measure of credit risk. The IMF's Paul Kupiec reports on efforts…

Countdown to Basel II

With Basel II set for implementation in three years' time, some banks in the Asia Pacific region are working hard to align their operational risk systems with the requirements outlined in the new Accord.

Using the grouped t-copula

Student-t copula models are popular, but can be over-simplistic when used to describe credit portfolios where the risk factors are numerous or dissimilar. Here, Stéphane Daul, Enrico De Giorgi, Filip Lindskog and Alexander McNeil construct a new,…

Operational and market risks of a regulated power utility

Victor Dvortsov and Ken Dragoon present an analytical method for including market and operational risks when estimating utility portfolio value-at-risk.

Operational and market risks of a regulated power utility

Victor Dvortsov and Ken Dragoon present an analytical method for including market and operational risks when estimating utility portfolio value-at-risk

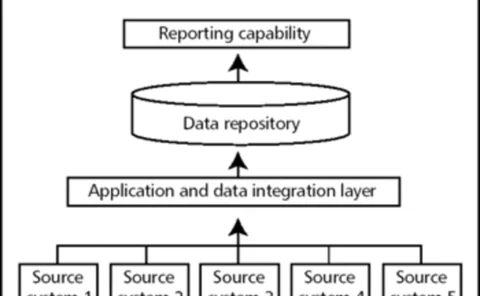

Getting it together

Data consolidation is now a vital foundation to any successful risk management implementation, as Dave Rose and Stuart Cook of The Structure Group report

VAR: history or simulation?

Greg Lambadiaris, Louiza Papadopoulou, George Skiadopoulos and Yiannis Zoulis assess the performance of historical and Monte Carlo simulation in calculating VAR, using data from the Greek stock and bond market. They find that while historical simulation…

Crossing the frontier

Portfolio risk management

VAR for fund managers

Investment management

Correlation stress testing for value-at-risk

The correlation matrix is of vital importance for value-at-risk (VAR) modelsin the financial industry. Risk managers are often interested in stressing a subsetof market factors within large-scale risk systems containing hundreds ofmarket variables…

Evaluating credit risk models using loss density forecasts

The evaluation of credit portfolio risk models is an important issue for both banks and regulators. It is impeded by the scarcity of credit events, long forecasthorizons, and data limitations. To make efficient use of available information, the…

VAR: history or simulation?

Greg Lambadiaris, Louiza Papadopoulou, George Skiadopoulos and Yiannis Zoulis assess theperformance of historical and Monte Carlo simulation in calculating VAR, using data from theGreek stock and bond market. They find that while historical simulation…

A true test for value-at-risk

The three classic approaches for measuring portfolio value-at-risk do not compare like with like, argues Richard Sage. Here he presents a test portfolio to highlight the differences between calculation methods

European buy side still lags in risk management

The findings of a recent survey show that buy-side firms have increased their focus on risk management, but are still well behind their sell-side counterparts.

How to run a market

Former-derivatives-trader-turned-author Frank Partnoy wants to see tougher accounting standards and risk disclosures to deter corporate crooks. But are the regulators listening? Maria Kielmas reports

How to spot a VaR cheat

Traders can use weaknesses in VaR measurement to make it appear that they are not taking any risks. Brett Humphreys exposes how easily this can be done

Sophis updates buy-side software

Sophis, a risk management technology vendor based in Paris, has released Value v2.0, a new version of its product for buy-side insitutions.

Project risk: improving Monte Carlo value-at-risk

Cashflows from projects and other structured deals can be as complicated as we are willing to allow, but the complexities of Monte Carlo project modelling need not complicate value-at-risk calculation. Here, Andrew Klinger imports least-squares valuation…

Basel's CDO solution

As the Basel Committee on Banking Supervision continues its stately progress towards a revised capital Accord, one area remains under debate: the proposed capital rules for asset securitisations.