Transaction costs

Bitcoin technology finds new uses in finance

Using blockchain should drastically speed up post-trade settlement

Notes on alpha stream optimization

This paper discusses aspects of optimizing weights for alpha streams (by alpha streams the author means a sequence of predictions of expected returns for each asset given by different models employed by portfolio managers).

Hirani, Masters and Wilson apply bitcoin to settlement risk

Derivatives market pioneers co-opt bitcoin tech in bid to transform mainstream markets

Cutting edge introduction: Hidden models for hidden costs

NYU quants use Bayesian techniques to sequence trades, considering trading costs and multiple assets

Multiperiod portfolio selection and Bayesian dynamic models

Kolm and Ritter present a multiperiod, multi-asset selection model with transacion costs, kept computationally tractrable

Bitcoin technology could slash transaction risk in banking

Using cryptography to validate transactions may transform finance

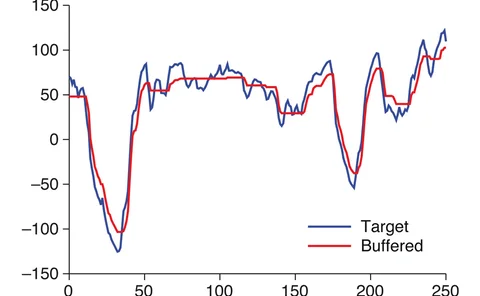

Optimal trading under proportional transaction costs

The theory of optimal trading under proportional transaction costs has been considered from a variety of perspectives. In this paper, Richard Martin shows that all results can be interpreted using a universal law through trading algorithm design

Hedge funds face automation challenge

Automation challenge

Trading costs force focus on maximising efficiency

Counting the cost

Mean reversion pays, but costs

Mean reversion pays, but costs

BP oil spill creates long-term oil risk management issues

BP’s Gulf of Mexico oil spill forces risk managers to look at long-term margin costs and soaring oil prices post-2012

Looking to the new horizon

Can a firm cut costs while increasing operational risk controls? This is just one of the many challenges facing the investment industry.

Value under liquidation

Liquidity