Solvency II

WHAT IS THIS? Europe’s Solvency II directive came into effect in 2016, putting risk at the heart of a harmonised prudential framework for insurance firms. Similar in outline to the banking industry’s Basel standards, Pillar 1 sets out quantitative requirements; Pillar 2 tackles risk management and governance; Pillar 3 addresses transparency, reporting and public disclosure.

Eiopa ‘politically naive’ to scrap national vetoes on long-term guarantees package

Agreement on Omnibus II more difficult if opt-outs removed, warn experts

LTGA proposals set to stoke divisions between insurers and lawmakers

Concerns that Eiopa's proposals will not work and could delay Solvency II

Insurers call for more transparent infrastructure investments

Structuring and regulation of assets frustrating investment, say market participants

Swedish insurers warn of manipulation threat to new discount curve

Concerns Solvency II-based risk-free curve could be distorted by speculators as market begins to adjust ALM hedges

Fears volatile model warning indicators could lead to unjustified action

UK regulator urged to reconsider proposed early-warning indicators to reflect better changes in economic conditions and not penalise insurers’ de-risking strategies

Life and Pensions Nordics: Insurers call for clarity on interim measures

Swedish regulator will not make guidelines legally binding on firms

Life and Pensions Nordics: Interim measures 'not undemocratic' – Eiopa

Guidelines 'necessary for convergence' but fears of two-speed implementation

Life and Pensions Nordics: regulators and insurers must respond to guarantees challenge

Solvency II must support long-term guarantees but insurers must develop simple products, says Nordea Life and Pensions CRO

Bernardino calls for dramatic extension of Eiopa's powers

Let Eiopa levy fees on insurers and carry out direct supervision, argues chairman

Shadow bank reforms ‘should prompt review’ of Solvency II money market fund charge

Treat regulated money market funds more like banks deposits, says top law firm

Risk-managing the next generation of savings products

Risk-managing the next generation of savings products

Solvency II interim measures a 'win-win' for insurers and supervisors - Bernardino

Guidelines necessary to achieve convergence and improve quality of preparations, says Eiopa chairman

UK annuity providers review credit risk strategies

Balancing act

The infrastructure investment challenge for insurers

Financing the growth agenda

UK regulator right to retain flexibility to force changes on internal models

Head of the PRA plans to use early warning indicators in supervisory work, notwithstanding the risk of EU challenge

Signs of recovery despite uncertainty

Sponsored forum: Luxembourg

Libor/OIS spread challenges insurers' risk management programmes

Spread carefully

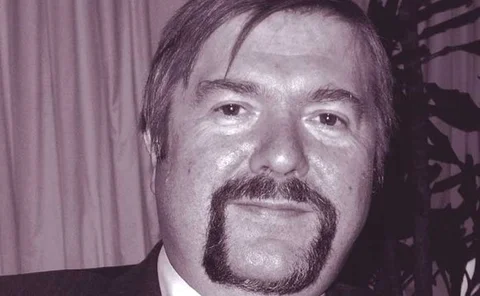

Van Hulle: Long-term investment agenda must not side-track Solvency II

Political focus on promoting long-term finance could be detrimental to insurance industry, warns European Commission's former Solvency II leader

Q&A: Karel Van Hulle on Solvency II delays and the challenges ahead

Beating the negative forces

‘Flawed’ standard formula currency risk calibration needs revision - Insurance Europe

Current specification is ‘counter-intuitive’, say industry experts

Solvency II set for inconsistent soft launch, lawyers warn

Absence of legal powers to enact guidelines in some jurisdictions threatens Eiopa’s objectives

Extensive reporting guidelines in Solvency II interim measures 'will challenge insurers'

Eiopa says measures will help supervisors and insurers prepare for Solvency II