Probability

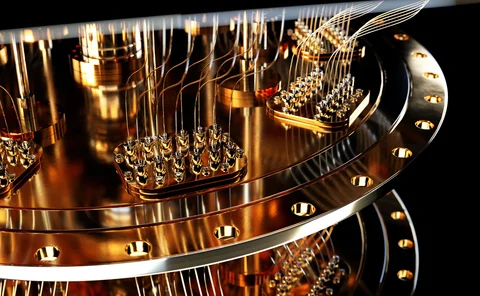

Podcast: Alexei Kondratyev on quantum computing

Imperial College London professor updates expectations for future tech

Corporate ‘greenium’ reveals effect of ESG rules on returns

Analysis of sustainable products shows how SFDR has caused a shift in investor behaviour, writes economist

CVA sensitivities, hedging and risk

A probabilistic machine learning approach to CVA calculations is proposed

Joint S&P 500/VIX smile calibration in discrete and continuous time

An arbitrage-free model for exotic options that captures smiles and futures is presented

Operational risk: a global examination based on bibliometric analysis

The authors quantitively assess the quality of research on operational risk and find that research in this area has grown in popularity in recent years.

IRB risk-weights highest at smallest EU banks – ECB

Lenders with less than €30 billion in assets consistently report lower risk densities than bigger banks across all modelled portfolios

EU banks add overlays as crises evade modelling

Lenders buttress provisions against unpredictable fallout from Russia's invasion of Ukraine

Nationwide’s IRB charges up 89% on PRA’s parameter curbs

The building society’s strict focus on mortgages meant impact was all-sweeping

New model simplifies loan-loss forecasts. Some say it’s too simple

Modelling approach devised by Commerzbank quant promises to ease computational burden, but may not suit complex portfolios

Building resilience into ESG risk management

Risk and resilience continue to play an important role in the navigation of an increasingly uncertain world. Fusion Risk Management explores why it is equally crucial for technology to support organisations in addressing pertinent environmental, social…

Operational resilience: charting evolution, strengthening impact

Arming a business in preparation for robust operational resilience measures is not a one-step solution – it continues to evolve. The key to strengthening defences against all events – especially the unlikely but plausible – is to build business agility…

Regions deploys early-warning tool for credit risk

Risk USA: system alerted US superregional to impending defaults during Covid crisis

Why the US election fallout was not a surprise to banks

A contested result was unexpected, but scenario planning meant banks weren’t unprepared

Ratings can still sharpen credit risk picture

Study shows even the most modern default models benefit from adding credit rating information

Consumer credit modelling software of the year – SAS

Risk Technology Awards 2020

Sometimes it’s fine to be boring

Diversification puts portfolios in the middle of the pack – where investors feel safe, writes Antonia Lim

Covid-19: Pandemic risk – Special report 2020

The economic devastation wrought by Covid-19 is already significant: the hits to employment, gross domestic product and other key macro factors regulators ask banks to test to has already surpassed supervisors’ severely adverse scenarios, and shows every…

Why credit risk managers need to see around corners

The Covid‑19 pandemic – and the subsequent extreme volatility – has exposed the fragility of long-established market and supply chain systems, affecting borrowers’ ability to repay debt. David Croen, global head of credit risk products at Bloomberg,…

Two-factor Black-Karasinski pricing kernel

Analytic formulas for bond prices and forward rates are derived by expanding existing rate models

Q&A: Ron Dembo on crowd-spotting black swans

Veteran quant argues large groups are better at gauging extreme uncertainty than small teams of experts