Pricing

Automated market-making tested by intraday FX vol

Price gaps in spot FX markets could be exacerbated by algos trading on headline risk

Citi rolls out revamped SDP in emerging markets

Unified API will boost electronic pricing and automation for restricted currencies, says bank

Trump’s tariff threats stress London gold market

Cost of funding customer positions has shot up 10,000% as deliverable supplies shift to New York

For AI’s magic hammer, every problem becomes a nail

Risk.net survey finds banks embracing a twin-track approach to AI in the front office: productivity tools today; transformation tomorrow

TD’s prop-style trading shop rises up bond rankings

Ascent of bank’s bond trading business comes amid electronification changes in US fixed income market structure

Bloomberg offers auto-RFQ chat feed – but banks want a bigger prize

Traders hope for unfettered access to IB chat so they can build their own AI-enhanced trading tools

Pricing time-capped American options using a least squares Monte Carlo method

This paper uses a modified least squares Monte Carlo method to price time-capped American options.

The path to operational resilience begins with reliability and risk management

The challenges Apac financial services firms face enhancing operational resilience and leveraging data and hybrid cloud

Pricing American options under irrational behavior in a Markov regime-switching model with a finite-element method

The authors investigate the problem of pricing American options under an irrational strategy, putting forward a method to negate this problem and demonstrate the performance of this model against alternatives.

Deep equal risk pricing of illiquid derivatives with multiple hedging instruments

The authors propose the using equal risk pricing for market-consistent valuation of illiquid financial derivatives, transferring information in liquid hedging strategy prices into the price of the illiquid derivative.

Bilateral streaming relationships set to grow, say LPs

FX Markets Europe: More clients are embracing APIs to access bank liquidity directly

Dealers weighing response to FXGO’s fee plans

Spread compression means costs will likely have to be passed to clients, say banks

Currency derivatives house of the year: UBS

Risk Awards 2025: Access to wealth management client base helped Swiss bank to recycle volatility and provide accurate pricing for a range of FX structures

Pricing and reference data in the cloud: fuelling opportunity today

A cloud-based security master can transform data management, analytics, automation and innovation across the enterprise

Forward thinking: banks adapt P&L markout tools for FX forwards

Dealers modify market impact measurement to get better handle on profitability – and client value

Pricing and trading system of the year: Murex

In contrast to previous years, trading activity in the Apac region is being driven increasingly more by local considerations, and this plays to Murex’s strengths: a technology vendor that offers in-depth market knowledge and extensive support across the…

Pricing and valuation systems 2024: market and vendor landscape

The landscape of pricing and valuation systems, considering the unique demands of different financial assets, as well as their market dynamics and interdependencies

A hard exit threshold strategy for market-makers

A closed-form solution to derive optimal stop-loss and profit-taking levels is presented

Jane Street ups its game in FX market-making

High-frequency trading firm now streaming bilateral spot FX liquidity to clients

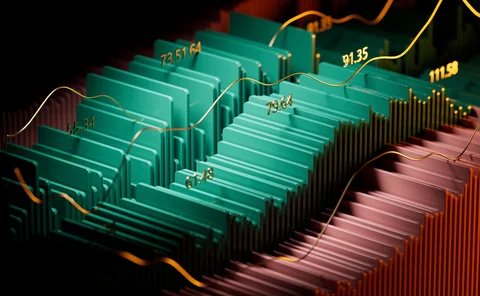

Recent volatility highlights tech’s vital role in fixed income pricing

MarketAxess’ Julien Alexandre discusses how cutting-edge technology is transforming pricing and execution in the fixed income market amid periodic bouts of volatility

Pricing share buy-backs: an alternative to optimal control

A new method applies optimised heuristic strategies to maximise share buy-back contracts’ value

Corporate ‘greenium’ reveals effect of ESG rules on returns

Analysis of sustainable products shows how SFDR has caused a shift in investor behaviour, writes economist

Model risk mitigation for pricing services: from the model owner’s lens

Financial markets rely heavily on quantitative models for decision-making, making effective model risk management crucial. Attika Raj, senior specialist, complex securities pricing at LSEG Data & Analytics, emphasises the importance of the first line of…

Rates markets rattled as tech outage hits broker pricing feeds

Dealers widened spreads and pulled live curves after TP Icap’s pricing feeds went offline