Pricing

Whales or minnows? Sizing up crowded trades

Strategies for measuring crowding in trades can help to avoid its effect, writes quant fund founder

Differential machine learning: the shape of things to come

A derivative pricing approximation method using neural networks and AAD speeds up calculations

Asia quant house of the year: UBS

Asia Risk Awards 2020

Pricing and trading system of the year: Murex

Asia Risk Technology Awards 2020

The econophysics of asset prices, returns and multiple expectations

The author models interactions between financial transactions and expectations and describe asset pricing and return disturbances.

A new arbitrage-free parametric volatility surface

A new arbitrage-free volatility surface with closed-form valuation and local volatility is introduced

Pricing data in fixed income markets – Is transparency truly an issue?

Jason Waight, head of regulatory affairs, Europe at MarketAxess, explains how investment in commercial transparency solutions has proven itself in 2020, and why this leaves a question mark over the potential value of a centralised bond tape

Studies test investors’ risk aversion after crash

Researchers use March tumult to investigate psychology of risk-taking

Deutsche Börse to exit regulatory reporting business

Pricing war and cost pressures force service providers to reconsider regulatory reporting businesses

A tale of two (or three, or four) models

Performance measure based on quality of replicating portfolios outperforms ‘P&L explain’, new paper claims

Choppy markets revive quest for RFQ’s ‘magic number’

Deutsche argues for smaller, stronger panels; Citi offers better prices for 'full amount' trades

Quantifying model performance

Quality of replicating portfolio is used to measure performance of a model

Structured products are lost in translation post-Libor

Benchmark shift would “fundamentally transform” popular rates structures, users fear

EU banks predict OTC trading terms will tighten – ECB

Almost one-quarter of surveyed lenders say conditions will deteriorate

Two-factor Black-Karasinski pricing kernel

Analytic formulas for bond prices and forward rates are derived by expanding existing rate models

Podcast: Kaminski and Ronn on negative oil and options pricing

The market is gravitating to the Bachelier model as an alternative to Black 76

The SABR forward smile

Thomas Roos presents the expressions for the implied volatilities of European and forward starting options

Discounting delay risks swaptions mess – Eurex

Swaptions hurdles seen as yet another reason to keep June €STR switch date

Fee fight: dealers take aim at brokerage costs

Old tensions have new edge as banks urge clients to bypass platforms

EU bank clients pressed for better trade terms in 2019

Hedge funds saw price and non-price conditions tighten in Q4

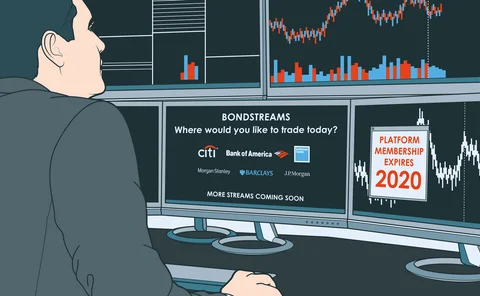

The corporate bond revolution will be streamed

Dealers are piping feeds of live, executable prices direct to select clients

Signing the Libor fallback protocol: a cautionary tale

As Orwell’s Room 101 beckons for Libor publication, muRisQ Advisory’s Marc Henrard warns of a potential pitfall in the fallback protocol

Initial margin – A regulatory bottleneck

With the recent announcement of an extended preparation period for those smaller entities needing to post initial margin under the uncleared margin rules, the new timetable could cause a bottleneck for firms busy repapering derivatives contracts linked…

The impact of the cross-shareholding network on extreme price movements: evidence from China

By using information about the ownership structure of listed companies from 2004 to 2016, the authors construct the cross-shareholding network for each year and examine the effects of the network position of a firm on extreme price movement.