This article was paid for by a contributing third party.More Information.

Recent volatility highlights tech’s vital role in fixed income pricing

MarketAxess’ Julien Alexandre discusses how cutting-edge technology is transforming pricing and execution in the fixed income market amid periodic bouts of volatility

The fixed income market has always been complex, but the market events of early August 2024 have underscored how crucial accurate and adaptive pricing can be in times of volatility. Julien Alexandre, global head of research at MarketAxess, emphasises the importance of technology in navigating these unpredictable conditions.

Market events

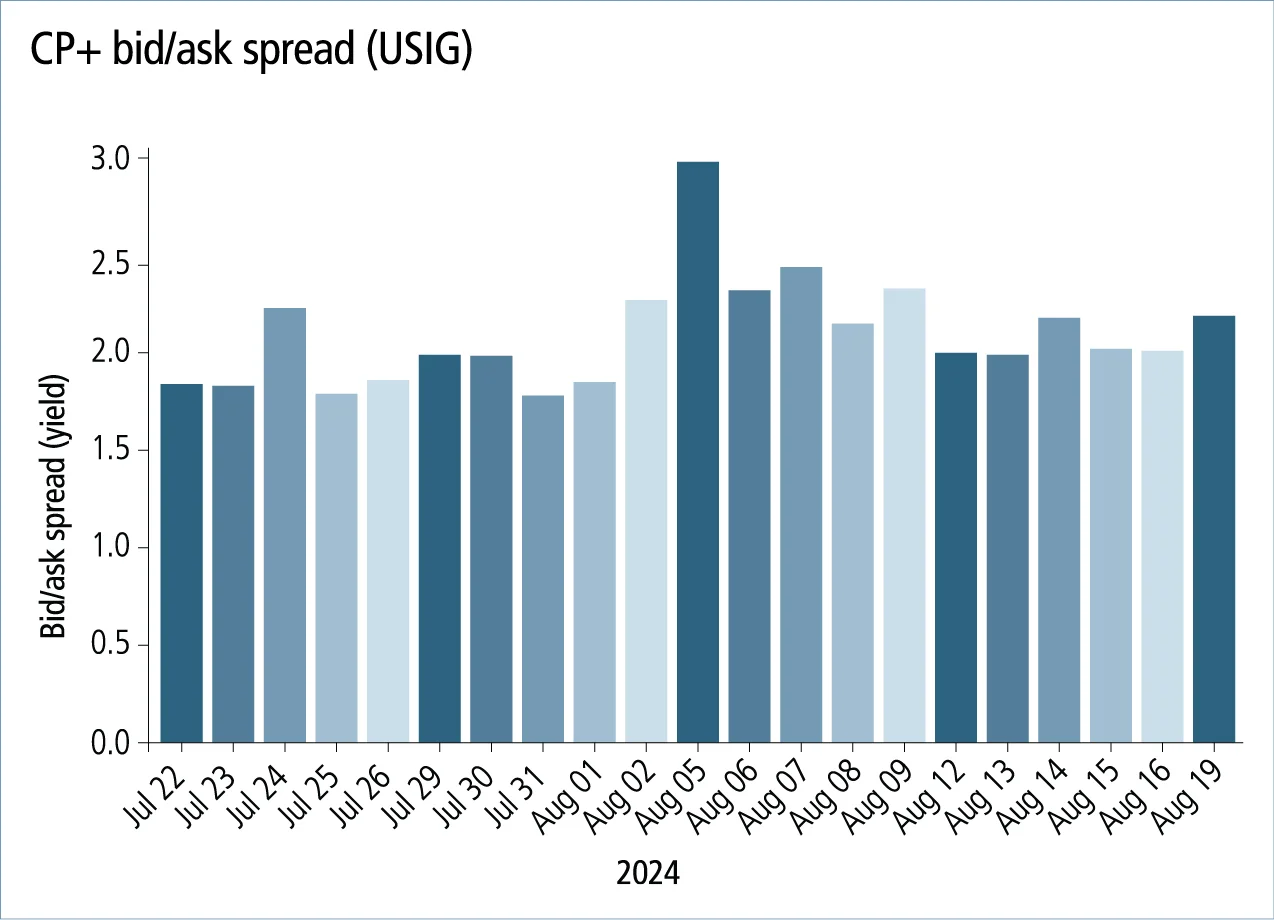

The sudden market turbulence in early August, driven by mounting concerns over an economic slowdown, sent shockwaves through the bond markets, rapidly widening bid/ask spreads. This abrupt change in market dynamics made it difficult for traders to assess the true value of their holdings, underscoring the need for pricing models that can swiftly adapt to new information.

“The bid/ask spread for US investment-grade [USIG] bonds increased by 50% in just two business days,” Alexandre remarks. This rapid shift, reflected in the cost of trading as proxied by CP+, the MarketAxess advanced bond pricing engine, highlighted market conditions reminiscent of the regional banking crisis in March 2023. During that crisis, the bid/ask spread for USIG bonds almost doubled within a week, making it incredibly challenging to access accurate pricing.

Both events underscored the limitations of traditional pricing approaches, which often struggle to keep pace with fast-changing conditions. They also revealed the importance of a pricing tool that has access to a broad range of data sources, including dealer quotes and requests for quotes (RFQs), to build a more comprehensive and accurate pricing model during times of market stress.

Fragmented market and pricing challenges

Unlike equities, where centralised exchanges facilitate price discovery, the fixed income market is characterised by its fragmented structure and wide array of securities. This fragmentation complicates the process of accurately pricing each security, as market participants must consider broad trends and the unique idiosyncrasies of individual bonds. “There is no centralised exchange like in equities, and there are a lot more instruments,” Alexandre explains. “The best example is that there are more than one million securities in the municipal bond market.” This vast and diverse landscape makes accessing reliable pricing data a significant challenge.

Each bond’s price can be influenced by myriad factors, making it difficult to establish accurate and consistent pricing across the market. This complexity is exacerbated during periods of market stress, where traditional pricing models may struggle to keep pace with rapidly changing conditions.

AI and cloud technology

The emergence of artificial intelligence (AI) and cloud computing has been pivotal in addressing these pricing challenges. These technologies enable the aggregation and analysis of vast datasets. “AI can integrate diverse data sources, such as trade data, dealer quotes and RFQs, to provide more accurate and adaptive pricing,” Alexandre says. By leveraging AI, firms can extract meaningful insights from a complex web of data, resulting in more precise and adaptive pricing strategies.

This adaptability is crucial, especially during volatile market conditions such as those experienced in August. As Alexandre notes: “AI is able to get more information out of more datasets than human-made rules would be able to, transforming raw inputs into meaningful information optimised for price prediction.” This allows for pricing that can adjust in real time to market dynamics, providing traders with the tools they need to navigate turbulent periods.

New market players

In addition to technological advancements, the fixed income market is also witnessing structural changes, particularly the rise of non-bank liquidity providers. These new entrants are capitalising on regulatory changes and technological innovations to compete in a market traditionally dominated by large banks. “The market is seeing an increase in non-bank liquidity providers due to regulatory changes and better access to technology,” Alexandre observes.

Protocols such as MarketAxess’ Open Trading are facilitating this shift by providing these new players with the infrastructure needed to provide liquidity without the need for extensive over-the-counter relationships. “This makes the process of getting into the market as a provider less complex and more efficient,” Alexandre adds. Access to advanced pricing tools further levels the playing field, reducing barriers to entry and enabling new participants to operate more effectively in the market.

Advancements in execution

As pricing models become more sophisticated, traders are better equipped to assess execution quality and identify opportunities for alpha generation. CP+ is a prime example of how technology is enhancing traders’ ability to spot mispricing and capitalise on relative value opportunities.

“CP+ is sharpening the signal-to-noise ratio, making alpha generation more accessible and reliable, especially in times of volatility,” Alexandre explains. This enhanced precision allows traders to differentiate between genuine opportunities and market noise, leading to more confident and more frequent trading decisions.

QA and machine learning

Looking ahead, the role of quantitative analysis (QA), machine learning and AI in fixed income trading is only set to grow. These technologies are already at the core of many trading protocols, providing real-time pricing and liquidity measurement for efficient execution. “QA and machine learning are crucial in fixed income trading because they enhance the capabilities of our trading protocols,” Alexandre says.

AI-powered tools such as Tradability are also helping traders navigate the complex landscape of fixed income trading by guiding them on the best execution methods for a given trade. With the launch of MarketAxess’ customisable user interface, X-Pro, users will be able to leverage tradability metrics and pricing information at the basket and line-item level for their portfolio trades. This will help them identify the best protocol for execution. As Alexandre explains: “Tradability helps traders decide which protocol is best for a given trade, whether it’s a portfolio trade, a list of RFQs or choosing between more high-touch workflows or low-touch execution.”

Conclusion

The events of August 2024 have demonstrated the critical importance of adaptive and accurate pricing in the fixed income market. As Alexandre emphasises: “It’s about gaining confidence in these tools and using them to really increase and improve the way trading is done.”

With AI, machine learning and cloud computing continuing to evolve, the fixed income market is becoming increasingly dynamic and data-driven, enabling traders and investors to navigate volatility with greater confidence and precision.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net