Operational risk

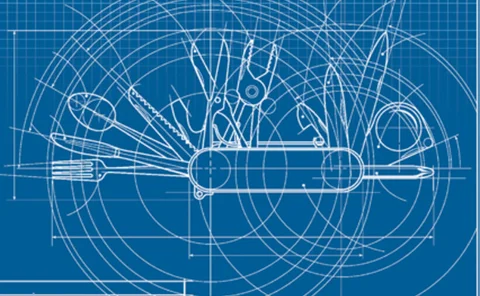

WHAT IS THIS? Operational risks are those arising from people, processes and systems – the biggest form of exposure for many industries, but one that was neglected by financial firms until the collapse of Barings Bank in 1995. It was added to the Basel capital framework in 2004, but attempts to model operational risk were dealt a heavy blow by the huge, unforeseen losses suffered by banks in the aftermath of the financial crisis.

How BlackRock's David Ridgway handles the truth

Handling the truth

Changing Hats, April 2011

The latest movers and shakers in operational risk

Japan crisis proves value of multivariate scenarios

Japan shows value of multivariate scenarios

Eiopa: Internal models beneficial under Solvency II

Eiopa: Internal models beneficial under Solvency II

OpRisk North America: ‘Nasty’ new regulation threatens foreign banks in the US

The Foreign Account Tax Compliance Act expected to impact on the systems and operations both of US and foreign firms

OpRisk North America: Moving OTC trades onto CCPs will increase op risks

Moving OTC trades onto CCPs will increase op risks

OpRisk North America: US foreclosure crisis highlights boundary risks

US foreclosure crisis highlights boundary risks

BoJ’s Miyao pledges continuity of settlements system during planned blackouts

Bank of Japan Policy Board member Ryuzo Miyao says in-house power generation at central bank branches would support settlements systems ahead of planned power shortages

OpRisk North America: Dodd-Frank clouds Basel III implementation

Requirement to remove credit ratings causing a headache for regulators

A dynamical approach to operational risk measurement

Research Papers

Accounting and risk management: the need for integration

Research Papers

ORR Innovation Awards 2011: Bank of the Year

National Australia Bank

ORR Innovation Awards 2011: Central Bank of the Year

Bank of Canada

Put your hands together

Put your hands together

ORR Innovation Awards 2011: Regulator of the Year

Marco Moscadelli, Bank of Italy

ORR Innovation Awards 2011: Product of the Year

Wolters Kluwer Financial Services’ ARC Logics for Financial Services

ORR Innovation Awards 2011: Manager of the Year

Giulio Mignola, Intesa Sanpaolo

Business continuity relies on adaptabilty amid civil unrest

Ready for anything

The ORR Innovation Awards 2011

ORR recognises those in the operational risk management profession who are working to ensure op risk keeps developing, and that it stays high on management’s agenda

Algorithmics patents operational risk capital modelling framework

Algos patents operational risk capital modelling framework

Vote for the top op risk software vendor

Cast your vote for the top vendor in a variety of operational risk management categories