Machine learning

Computer says no: combating bias in machine learning models

Proposed US law on algo lending targets in-built discrimination, say modelling experts

Allianz Global Investors adopts NLP signals in equities

Move to tackle unstructured data starts with sell-side analyst reports

Deploying agile analytics in the fight against fraud

Financial firms are under pressure to tackle the widespread problem of financial fraud. As the speed, scale and sophistication of fraudulent activity grows, a panel of financial crime experts reveal how firms can develop an agile analytics capability to…

Harnessing AI to achieve Libor transition

Chris Dias, principal at KPMG, explains how the vast increase in accuracy that artificial intelligence (AI) offers when dealing with large volumes of complex agreements is crucial to exploring the market opportunities and mitigating the risks of the…

Machine learning, Deutsche auction and repo haircuts

The week on Risk.net, September 14–20, 2019

Neuberger sidesteps option gap risk using AI and credit card data

Random-forest algorithm run on retail transaction data forewarns of earning shocks

Some quant shops doomed to ‘struggle’ – López de Prado

Theory-first firms must modernise their methods or wither, says machine learning expert

ETF provider of the year: Yuanta SITC

Asia Risk Awards 2019

An advanced hybrid classification technique for credit risk evaluation

In this paper, the authors employ a hybrid approach to design a practical and effective CRE model based on a deep belief network (DBN) and the K-means method.

NLP sniffs out contracts harbouring Eonia as fallback

Test finds wide range of 4,000 Libor euro contracts examined could end up in the flagging Eonia rate

Pimco deploys neural net model in agency bonds

Old models for $7 trillion mortgage market overstate risk in some cases, asset manager says

Goldman improves execution ‘by 50%’ with new algos

Bank uses neural networks and other AI tools to cut slippage in stock trading

The machines are coming for your pricing models

Deep learning is opening up new frontiers in financial engineering and risk management

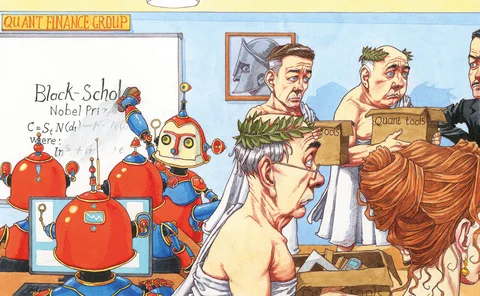

The rise of the robot quant

The latest big idea in machine learning is to automate the drudge work in model-building for quants

Margin reform – From challenge to opportunity

SmartStream Technologies explores how, as new initial margin regulations from the Basel Committee on Banking Supervision and the International Organisation of Securities Commissions become a pressing concern for more firms, technology service providers…

Deep hedging and the end of the Black-Scholes era

Quants are embracing the idea of ‘model free’ pricing and hedging

Optimal posting of collateral with recurrent neural networks

Pierre Henry-Labordère applies neural networks to a control problem approach for managing collateral

QMA’s Dyson: AI a ‘wonderful marketing concept’

Quant firm sceptical about using artificial intelligence to seek out tradable strategies

GAM Systematic’s Ewan Kirk is sticking to his guns

Have markets changed? “They always do,” says quant fund CIO

AllianceBernstein uses AI to sidestep ‘growth trap’

Random forest model aims to sort success stories like Amazon and Netflix from fast-growth losers

Finra plans machine learning push against market rigging

ML trained to find spoofing and layering

PanAgora uses NLP to cut through Chinese cyber speak

Fund builds Mandarin-reading algo to gauge sentiment of retail investors