Liquidity

Smooth start for Texas nodal

Smooth start for Texas nodal day-ahead market

Sponsored statement: OpenLink

Hard markets for softs? The case for holistic risk management in agricultural commodity markets

Infrastructure - opportunity for pension funds and insurers?

Building capital

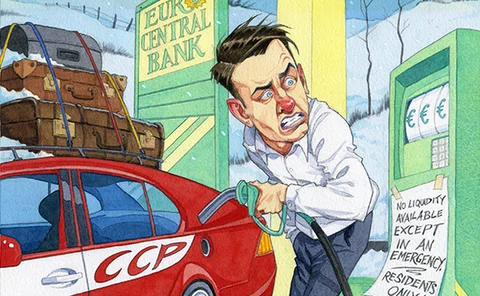

The debate over CCP central bank liquidity

The liquidity access debate

Lifetime achievement award: John Hull

Risk awards 2011

Stoxx climbs onto emerging markets bandwagon

Stoxx climbs onto emerging markets bandwagon

Why funding liquidity risk deserves a place at the risk table

A place at the table

King called for global bailout in March 2008: WikiLeak

Bank of England governor told US ambassador of need for nations to cooperate in order to recapitalise banking sector

Mergers and acquisitions: hitching a ride on the recovery

Tapping M&A targets

CCP turf war simmers as OTC regulations head to the European Parliament

CCP turf war simmers as OTC regs head to European Parliament

Banks moving to build liquidity ahead of Basel III

Building up buffers

Risk technology rankings 2010

The age of change

S&P launches Euro 75 Index

S&P launches Euro 75 Index

Sponsored feature: The ultimate risk – flawed liquidity risk management

The ultimate risk – flawed liquidity risk management

BoE: High-frequency traders raise risks of liquidity event

Potential liquidity mirage in foreign exchange markets must be addressed, says Michael Cross

Asia Risk Congress 2010: G-20 summit a success on regulation, says Korean official

In his keynote speech, Korean regulator Jong-Goo Yi highlighted the G-20's success in agreeing international regulatory reform.

Insurers, not banks, driving liquidity trade

Insurance sector's hunger for high yields, rather than banks' thirst for short-term funding, driving liquidity trade

Central banks move to bolster liquidity in Islamic paper

Eleven central banks and monetary authorities are teaming up with Islamic multilateral organisations in an effort to bolster supply of highly rated, short-term Islamic paper through an entity called the International Islamic Liquidity Management Corp…

Curbs on bank trading activity hit liquidity

Squeezing every last drop

A liquid market – banks tap insurers' liquidity reserves

A liquid market

Australia’s power market

New kid on the bloc

Are there enough liquid assets to satisfy regulations?

Grease is the word

Sponsored forum: US inflation derivatives

Developments in the US inflation derivatives market