Liquidity

Central bank liquidity would help CCPs in distressed situations, says BIS

BIS weighs in on CCP central bank liquidity access debate

Supervisors seek to manage shadow banking risks

Chasing shadows

Asia’s banks move to meet new capital and liquidity rules

A capital plan

Investors debate the future of Australian debt markets

Debt prospecting down-under

Nomura launches South Korea Government Bond Index featuring liquidity screening

The South Korea Government Bond Index aims to offer investors increased tradability through the use of a liquidity enhancement mechanism

Australian banks still face many liquidity challenges

The liquidity conundrum

Criticism of Basel III liquidity ratios continues

Rationalising ratios

Risk Australia Autumn 2011

Counting the costs

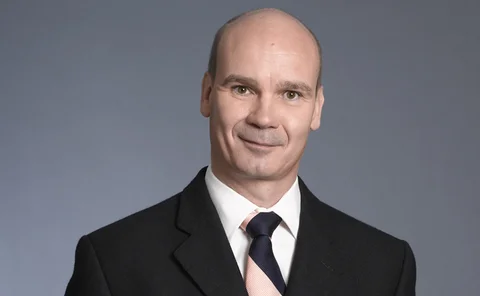

Video: Algorithmics' Michael Zerbs on the ‘unintended consequences’ from Basel III

Algorithmics' president and chief operating officer Michael Zerbs talks about the long-term impact of moving from Basel II to Basel III, including some 'unintended consequences' likely to emerge from the move to central clearing as well as the specific…

FSB concerned about counterparty and liquidity risk in ETF market

FSB warns of counterparty risk due to rapid growth of synthetic ETF market; also expresses concern about on-demand liquidity in stressed conditions, particularly linked with vertically integrated providers.

Leave liquidity rules out of Basel III legislation, says EBF

Industry group fears European Union legislative process will set LCR and NSFR flaws in stone

Asian investors love liquidity but drawn to risk, says BarCap survey

Asian investors love liquidity but drawn to risk, says BarCap survey

Regulation acting as bar to global long-term investing

Regulation acting as bar to global long-term investing

Risk Europe: Roles of ESRB and ECB could conflict, says Belgium's Reynders

Europe's new systemic risk watchdog could clash with the ECB - but the ESRB's powers may need to be expanded, says Belgian finance minister, Didier Reynders

Risk Europe: Tweaks to Basel III will raise deadline pressure for banks

Changes to the detail of Basel III will make timely implementation a challenge, say attendees at Risk Europe

Collateral management: Firms face up to regulatory challenge

Balancing the books

Q&A: Gary Germeroth, chief risk officer at Calpine

Power resurgence

Risk Europe: 'Humble' Basel Committee open to liquidity rule changes

The Basel Committee's Stefan Walter says door is open to changing LCR and NSFR - but it's not open wide

Asian regulators get tough on liquidity ring-fencing

Ring-fencing liquidity

Risky funding with counterparty and liquidity charges

Risky funding with counterparty and liquidity charges

Structured products versus ETFs: Which is best?

Blurring the boundaries

HKMA’s Yuen urges banks to take action now on Basel III LCR; warns of negative impact for corporate debt markets

Banks should begin preparing in earnest to meet the Basel III liquidity requirements as regulators begin the process of supervising banks’ compliance with the new rules, according to the deputy chief executive of the HKMA.