Dodd-Frank Act

WHAT IS THIS? Properly known as the Dodd-Frank Wall Street Reform and Consumer Protection Act, this controversial US legislative package enacted a host of reforms agreed by the G20 nations in the aftermath of the financial crisis, including rules on the clearing, execution and reporting of standardised swaps. It also introduced the Volcker rule ban on proprietary trading by banks, and a new way of liquidating big institutions.

Futures will not beat swaps on margin alone, say buy-side firms

Swap futures have a number of advantages, but OTC instruments will continue to be popular, leading buy-side firms say

Volcker still likely to cause damage, expert warns

US banks remain highly cautious about the impact of Volcker rule, industry expert says

Dealing with CCP proliferation

A variety of clearing houses are emerging in Asia – in some cases, backed by domestic clearing requirements for local currency derivatives. That poses some difficult questions for participants active across the region. Should they sign up to all of them…

Swaps vs futures: OTC market speaks out

Swaps vs futures: OTC market speaks out

Energy firms struggle to meet Dodd-Frank reporting deadline

With Dodd-Frank reporting and record-keeping rules set to come into effect on April 10, energy companies worry they won’t be ready in time

Rolling spot faces inclusion in Dodd-Frank

Forex spot is expected to be exempt from US clearing and exchange trading rules, but rolling spot could be classified as a CFD and so be included within the scope of Dodd-Frank

Late nights and illegality – but start of clearing in US goes well

The days either side of the first US clearing deadline saw last-minute decisions by clients and regulators, operational niggles and some illegality

Sefs find liquidity comes at a cost

Banks have been reluctant to pick winners and losers from the array of new derivatives trading platforms being set up, but with Citi and Morgan Stanley taking equity stakes in two venues at the end of last year, it looks like some dealers are finally…

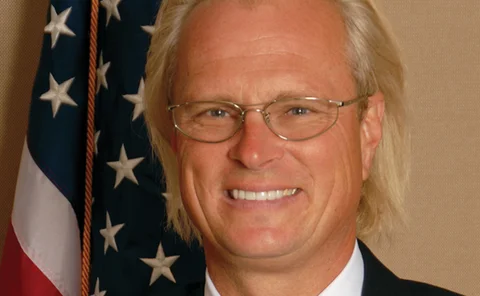

CFTC: O'Malia on a mission to fix Dodd-Frank flaws

With the end of the agency's marathon Dodd-Frank Act rulemaking in sight, CFTC commissioner Scott O'Malia wants to go back and fix what he sees as mistakes. By Peter Madigan

Combating the collateral crunch

Sponsored statement: BNY Mellon

CFTC ‘neglect’ of Sef rules angers platform providers

After missing numerous deadlines to finalise the criteria for Sefs, the CFTC will not publish the rules until late April at the earliest, much to the frustration of market participants

Extraterritoriality, uncleared margin and futurisation – Isda on OTC derivatives reform

The first clearing mandates came into force in the US on March 11, but there is still plenty of uncertainty about how certain parts of the new regulatory framework will function. In this roundtable discussion, Nick Sawyer talks to two senior board…

Extraterritoriality: US person definition doubt

The Dodd-Frank Act requires any trade involving a US person to meet strict new regulatory requirements. The first mandatory clearing requirements are now in force – but the definition of US person is still not finalised, creating havoc for firms trying…

OpRisk North America: Regulator warns industry to get implementation of Dodd-Frank right

Implementation of Dodd-Frank Act raises op risk concerns, conference hears

Broader US person definition could cause clearing avalanche, participants warn

A large number of offshore funds could be classified as US persons once a CFTC exemption expires in July, subjecting them to Dodd-Frank transaction-level rules

Risk & Return Cape Town: Treasury official calls for clarity on CCP equivalence

Lack of clarity on CCP equivalency leaves South African rules in limbo, says National Treasury's Natalie Labuschagne

Extraterritorial clash continues for clearing houses

While the Group of 20 nations want to see progress with financial regulatory reforms, individual authorities around the world are reluctant to relinquish domestic sovereignty over standards for central counterparties. Luke Clancy reports

Swap futures margins may be underestimating risk exposures

A difference in margin approach between swaps and futures may mean the latter are not assessed on their level of riskiness

SEC slammed for CDS cross-margin hurdle

CDS users face collateral hike because SEC rule means clearing members are not yet able to offer CDS cross-margining to their clients – but there are hopes of a last-minute exemption

Newedge to offer OTC clearing in Asia

Broker seeks to broaden its Asia offering by adding OTC IRS clearing in Singapore

CFTC's Gensler: Industry is ready for March 11 clearing deadline

Preparations are "running very smoothly" says CFTC chairman, ahead of first clearing deadline

Active funds list causes furore

Listed firms complain about breach of confidentiality – others say they are victim of human error – after Risk publishes list of fund managers that face March 11 clearing deadline

US agencies "extremely focused" on Volcker rule, says Dept of Treasury

Overseer of Volcker rule work says five US agencies should produce a single rule – and are not planning to harmonise it with Europe's ring-fencing proposals