Dodd-Frank Act

WHAT IS THIS? Properly known as the Dodd-Frank Wall Street Reform and Consumer Protection Act, this controversial US legislative package enacted a host of reforms agreed by the G20 nations in the aftermath of the financial crisis, including rules on the clearing, execution and reporting of standardised swaps. It also introduced the Volcker rule ban on proprietary trading by banks, and a new way of liquidating big institutions.

Asian energy markets liquid enough to sidestep Dodd-Frank compliant firms

The extraterritorial impact of the US Dodd-Frank could be sidestepped by Asian players opting to conduct swap trades with players outside of the regulation’s orbit

The last word: Basel III

The leading question

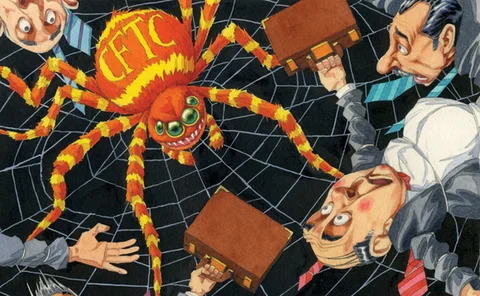

Trade reporting pressure increases as CFTC deadlines loom

DTCC data repository has received provisional CFTC approval, just three weeks ahead of mandatory reporting for credit and rates, with forex reporting due to begin in January

CME’s new swap future uses Goldman Sachs patent

Licensing agreement could be worth up to 20% of revenues from patented contract, and is seen as an attempt by Goldman Sachs to hedge its bets as new rules threaten OTC market profits

OTC Derivatives Clearing Summit: Nearly a third of uncleared CDS are clearing-eligible

SEC study finds large portion of clearing-eligible CDS still trading bilaterally

OTC Derivatives Clearing Summit: Industry will struggle to meet clearing deadlines

Buy-side firms will struggle to finish legal and operational work ahead of US mandated clearing deadlines – and they are not the only ones, says panel

New Isda protocol may not fix business conduct bottleneck

Dealers hope to comply with new business conduct rules by amending thousands of Isda master agreements – but a standardised protocol published last month is expected to leave some clients cold

Fingerprint, aggregation fears hit swap dealer countdown

Prints and be damned

The agent-principal dilemma

The agent-principal dilemma

What will clearing cost?

What will clearing cost?

Neal Wolkoff: OTC market faces break-up blues

Break-up blues

Energy firms gear up for new data management requirements

Dealing with a data flood

Regulation to hit bank profitability - Risk survey

Dealers expect new rules to hit the profitability of their business, but fewer expect to be able to pass the costs along – and more are anticipating a big drop in OTC trading volumes

Sefs hit by Dodd-Frank disclosure rules

New trading platforms must enable dealers to make pre-trade disclosures – but industry doesn't know what information needs to be provided

Reprieve for dealers as CFTC extends business conduct deadline

Ten-week extension comes as welcome surprise to dealers, but industry still has concerns about timing and content of new rules

CFTC cross-border guidance a threat to ‘systemic stability’, say Asian regulators

Leading regulators from across Asia complain of the potentially negative impact of the US regulator’s latest proposals

Publication of swap definitions triggers countdown to compliance deadline

The publication of swap definitions earlier this week initiates a 60-day countdown for compliance to key parts of the Dodd-Frank Act

Errors in CFTC extraterritorial guidance to be amended

A CFTC source acknowledges that inconsistencies in the proposed interpretative guidance on the cross-border application of Dodd-Frank will have to be ironed out

Dodd-Frank introduces technology challenges

Race to the finish

Risk 25: The search for margin efficiency

Margin efficiency: The new battleground