Collateral

Sponsored feature: BNY Mellon – focusing clients on their core activities

Never has the need for efficient management around over-the-counter derivatives business been more crucial, or such a focus, as it is today. BNY Mellon discusses how, with its collateral management services, it has helped clients achieve greater…

Dampening pro-cyclicality in margin

The Committee on the Global Financial System has released a proposal recommending changes to dampen pro-cyclicality in margin practices and haircuts for securities financing and over-the-counter derivatives. How could this affect collateral management…

Buy side steers clear of CCPs

Regulators have pushed hard to ensure buy-side firms are able to access central counterparties since the crisis began. But despite the launch of several new services, very few buy-side participants are actually using them. By Mark Pengelly

Prime brokers move to SAS 70 audits

Learning from the default of Lehman Brothers, a growing number of prime brokers are adapting their business model to ensure margin is segregated and secure, with some looking to win third-party validation for the controls they have in place. Which firms…

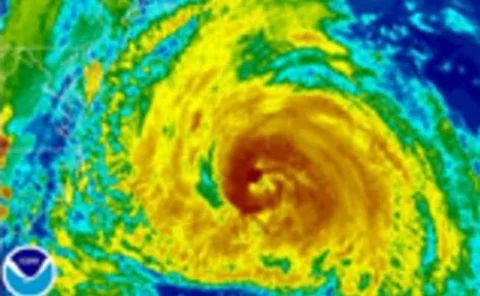

Cat bonds return

The market for catastrophe bonds dried up in 2008 and early 2009 as the financial crisis took its toll. Confidence is returning, helped by wide spreads and a re-think about the assets used to collateralise catastrophe bonds, but issuance has yet to…

Through-the-cycle haircut in securities financing likely, says senior regulator

Supervisors look to keep a firmer grip on securities lending haircuts to prevent asset bubbles from forming.

Isda AGM: collateral drops 20% with market rebound

As the markets recover from the crisis, counterparties are using much lower levels of collateral, an Isda survey has found.

The price is wrong

As the basis between Libor and overnight index swap rates ballooned during the credit crisis, banks were forced to reassess methods for pricing collateralised and uncollateralised derivatives trades. The result is a move towards a new market standard in…

Risk corporate survey 2010

Price is still the most important factor for corporates when choosing which dealer to trade with. However, a wide divergence in pricing among banks means transparency is now a key issue. By Matt Cameron, with additional research by Alexander Campbell,…

The price is wrong

As the basis between Libor and overnight index swap rates ballooned during the credit crisis, banks were forced to reassess methods for pricing collateralised and uncollateralised derivatives trades. The result is a move towards a new market standard in…

The Lehman flip clause flap

The decision of a US bankruptcy court to void contractual provisions that shield investors from the credit risk of swap counterparties in structured finance deals has put the legal systems of England and the US on a collision course. It also has…

Interview with Vladimir Piterbarg

Vladimir Piterbarg talks about his new article published in the Cutting Edge section of Risk magazine

Funding beyond discounting: collateral agreements and derivatives pricing

Standard theory assumes traders can lend and borrow at a risk-free rate, ignoring the intricacies of the repo and collateralisation markets. Here, Vladimir Piterbarg shows that these force adjustments to discounting, forward prices and implied…

Ferc proposes credit reforms

The Federal Energy Regulatory Commission (Ferc) has outlined credit reform proposals aimed at balancing the need for market liquidity with appropriate risk management while ensuring reasonable rates.