Collateral

OECD debt offices call for derivatives collateral debate

New report calls for debt offices to weigh the pros and cons of two-way collateral and clearing

Corporates complain about transparency of unwinds

Wound up by unwinds

Risk software survey 2011

Compliance is key

Review of 2011: collateral, capital and chaos

Collateral, capital and chaos

New standard CSA too dollar-centric, say Asian banks

Banks in Asia-Pacific complain about dollar dominance in new standard CSA – prompting Isda to rethink its plans

MF Global: non-US clients caught in cross-border collateral trap

Omnibus structure meant clearing clients of MF Global outside the US were asked to double up on collateral payments. Use of the structure for OTC markets is now in doubt

Is asset-backed credit support an option for energy firms?

Coming up with the money

Eksportfinans faces collateral questions following downgrade

Junk-rated export lender says it has enough reserve liquidity to meet obligations while it is being wound up - but dealers are not convinced

ECB offers CSDs financial incentives for early T2S adoption

European Central Bank offers central securities depositories (CSDs) financial incentives to sign up to T2S early; governing council gives CSDs until the end of April to agree

Banque de France outsources collateral management

French central bank agrees collateral management deal with Euroclear France; entire French banking community will use new system next year

Energy players assess MF Global fallout

MF Global’s bankruptcy is unlikely to significantly impact commodity markets, participants say, but could affect the Dodd-Frank rule-making process

Margin minutiae at issue in Jefferies v IDCG suit

Mire in margin minutiae

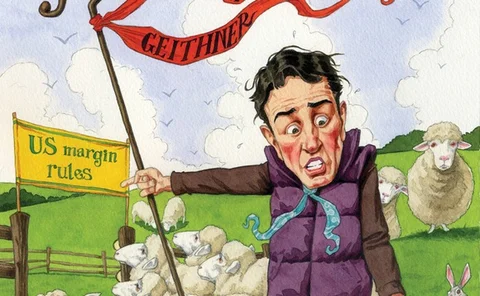

Foreign regulators leave US isolated on uncleared margin rules

Follow the leader?

Standard CSA: Industry's solution to novation bottleneck gets nearer

New CSA, new challenge

EBA stress test: Santander’s sovereign swaps exposure not disclosed

Banco de España chose not to report Santander’s sovereign derivatives exposure to the EBA because it was 'not material'

CME and IDCG revalue swaps using OIS discounting

Switch to OIS comes a year after SwapClear revalued parts of its portfolio

CCP contest starting to heat up

Give CCPs a chance

Corporates fear CVA charge will make hedging too expensive

Crunch time for corporates

South African banks grumble over credit pricing discrepancies

To charge, or not to charge?

SwapClear may assist OIS development

SwapClear may assist OIS development

Foreign regulators leave US isolated on uncleared margin rules

The extraterritorial application of US uncleared margin proposals will make it tough for US banks to compete with their foreign counterparts unless the proposals are copied by regulators elsewhere

Standard CSA: Industry's solution to novation bottleneck gets nearer

New CSA, new challenge