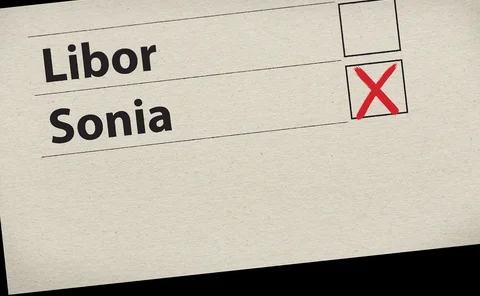

Benchmark

Dealers cast doubt on swaptions compensation plans

Redress scheme for victims of post-Libor valuation change may fail due to “cherry-picking” fears

Sonia’s share of sterling swaps tipped to hit 80% by year-end

Ahead of Monday’s convention switch, dealers already view Sonia as the primary sterling rate

FCA: sign up to fallback protocol or face ‘serious questions’

UK regulator urges derivatives users to accept Isda swap fallbacks to ensure compliance with benchmark law

BoE to publish ‘golden source’ compounded Sonia index in July

UK to align with US in effort eliminate interest calculation mismatches and turbo-charge adoption

ICAAP/ILAAP – Unlocking business value from capital and liquidity assessment

Regulators consider banks’ internal capital adequacy and assessment process (ICAAP) and internal liquidity adequacy assessment process (ILAAP) important tools in managing risk. The European Central Bank’s (ECB’s) updated guidance – which came into effect…

Dealers prefer repo for new risk-free rate in Korea

Unsecured rate undercut by dwindling transactions in local call market

€5trn of Eonia swaps mature after benchmark’s death

Almost 20% of derivatives notionals linked to retiring rate will expire post-2022

SOFR discounting – Analysing the market impact

The switch to secured overnight financing rate (SOFR) discounting brings several complex issues and is impacting market practices. Ping Sun, senior vice‑president of financial engineering at Numerix, discusses the key issues, such as the differences…

Chinese banks set for mass loan repricing

Options launch slated for February to help industry switch to new benchmark by August

First SOFR versus CORRA cross-currency swap hits market

JP Morgan and National Bank of Canada extend SOFR cross-currency trading into Canadian market

FCA dismisses Libor credit component concerns

UK regulator bemused by distress raised by US regional banks to Fed

Fast-track SOFR term rate, says JP Morgan’s Pluta

Traders divided on whether liquidity in SOFR futures is sufficient to support a forward rate

Credit risk – The bank data challenge in frontier markets

As the regulatory net tightens, banks working in and across frontier regions are under pressure to source and maintain more accurate data in the assessment of counterparty credit risk, but some are investing in tools to tackle the problem

Why the numbers don’t add up for post-Libor hedge accounting

Experts raise concerns over IASB’s Phase II plans to move on from Libor

Libor limbo: loan market fallback language upends lenders

Banks seek to replace painful fallback language in loan docs and avoid a cost-of-funds contingency

Signing the Libor fallback protocol: a cautionary tale

As Orwell’s Room 101 beckons for Libor publication, muRisQ Advisory’s Marc Henrard warns of a potential pitfall in the fallback protocol

Judgement day looms for dealers in swap shift to Sonia

Regulator pushes Q1 deadline for users to adopt risk-free rate as norm for interdealer trades

EU compounding confusion creates headaches for banks

With the fallback possibly illegal in some EU states, loan system updates may become more complicated

Lloyds plans £4bn Sonia shift for covered bond extension clause

Consent solicitation aims to flip one-year Libor-linked grace period on fixed instruments to RFR

Compounded rate out of favour, finds Japan survey

Users prefer forward-looking term rate to replace yen Libor, but dealers bemoan “lack of understanding”

Zombie Libor, climate risk flaw, Mifid’s closed door

The week on Risk.net, December 7–13, 2019

Initial margin – A regulatory bottleneck

With the recent announcement of an extended preparation period for those smaller entities needing to post initial margin under the uncleared margin rules, the new timetable could cause a bottleneck for firms busy repapering derivatives contracts linked…

Euribor fallbacks could hit thin legal ice

In Italy and Germany, compound interest – the foundation of Euribor fallbacks – is actually illegal

BMR rift fuels zombie Libor uncertainty

False rate could limp on for months under EU’s benchmark regulation