Benchmark

Statisticians grapple with inflation impact of Covid-19

Collecting reliable inflation figures during lockdown is not straightforward

Banks reject SOFR in Fed’s Covid lending schemes

Emergency loans to businesses get caught up in Libor transition

How regional banks could shape US Libor replacement

Regulators convene working group to address credit sensitivity concerns

Lawyers pick holes in Libor statutory fix

US ‘tough legacy’ contracts open to legal challenge even if proposed New York law is passed

Lloyds and Riverside rehitch revolving loan to Sonia

£100m Sonia facility overcame late operational hurdles to be among the first done since the onset of coronavirus

Japanese dealers join calls for Libor extension

Local firms struggle to adapt to remote working as coronavirus throws benchmark transition plans off course

Libor webinars: loans, bonds and derivatives

Listen here to three Risk.net webinars, covering topics from transition timelines to market turmoil

Uncharted waters

How pension plans can better equip themselves for a period of economic upheaval. By Matthew Seymour, RiskFirst, a Moody’s Analytics Company

Libor webinar playback: spotlight on derivatives

Panellists from Deutsche Bank, LCH, Numerix and Tradeweb on transition timelines, volatility and discounting

Virus turmoil threatens swaps discounting switch

Clearing houses expect deadlines to be met, but swaps users are not so sure

Libor Risk – Quarterly report Q1 2020

Regulators may have to accept Libor transition will be slower than they hoped. But the final framework may yet be more robust as a result. Knowing how rates perform in times of stress will be crucial to the success of benchmarks intended for real economy…

Covid-19 disruptions expose Libor loan fallback flaws

Amending legacy loans during a crisis will prove challenging, ARRC member warns

Libor webinar playback: spotlight on loans

Panellists from McKinsey, the LSTA and UBS discuss efforts to switch lending to new benchmarks

Seeing red over blue-chip swap in Argentina’s NDF fiasco

Emta protocol salve aside, peso settlement rate snafu is a warning for emerging market FX derivatives

Pre-cessation Ibor picture gets clearer

As the derivatives market has accepted the impending transition away from interbank offered rates, attention has turned to how best to manage it. Philip Whitehurst, head of service development, rates at LCH, explores how the clearing house is working…

A sea change – Driving awareness to confront climate risk

Amid a global push towards green policies, the reality of overhauling how industries worth trillions of dollars operate is causing concern. A forum of market participants and sponsors of this report discuss the levels of awareness of climate risk and its…

Rate volatility highlights benchmark flaws

Libor and SOFR in spotlight following market rout, as both decouple from commercial paper

Swaps benchmark vanishes as traders flee firm price venues

Dollar Ice swap rate fails to publish in March rout; patchy Sonia Clob prices could delay term rates

Operational uncertainty – An unavoidable challenge

The transition from Libor to a new risk-free rate has revealed a number of challenges for all financial markets participants – the nature and scope of what lies ahead is vast, impacting businesses, operations and support functions. KPMG‘s global Libor…

Pandemic threatens Libor transition plans

Resources diverted to Covid-19 response, as RFR-Libor basis spikes on stress

Sonia swaps surge not mirrored by futures

Popularity of short sterling futures takes shine off Sonia’s RFR succession

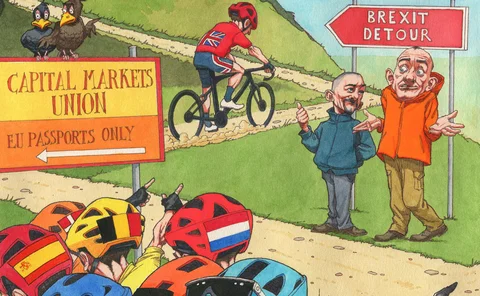

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

Japan selects term risk-free rate vendor

Sketchy volumes in overnight index swaps hold up calculation methodology