This article was paid for by a contributing third party.More Information.

SOFR discounting – Analysing the market impact

The switch to secured overnight financing rate (SOFR) discounting brings several complex issues and is impacting market practices. Ping Sun, senior vice‑president of financial engineering at Numerix, discusses the key issues, such as the differences between overnight index swaps (OIS) curves and SOFR curves, the dynamics of SOFR discounting risk and the impact of SOFR discounting on future cashflows

A considerable amount of SOFR trading activity took place in 2019, which has helped solidify the picture of how the switch from OIS – which are based on the daily effective federal funds rate (EFFR) – to SOFR discounting will impact the market. Awareness of the effects of this change will be central to understanding its significance for trading and risk management going forward.

The transition from OIS to SOFR discounting

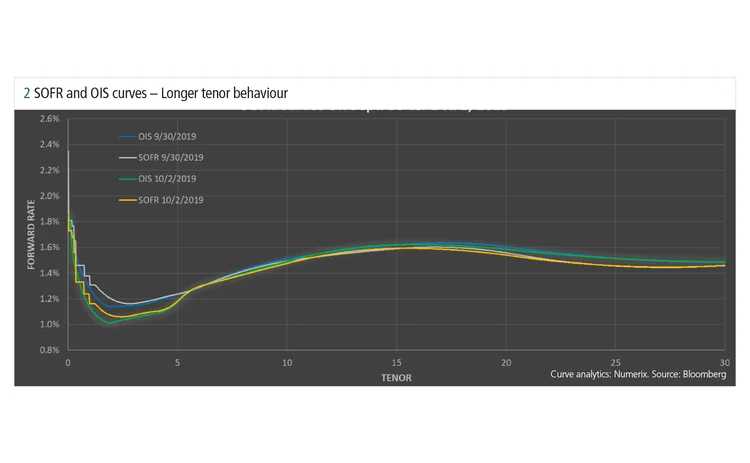

The first critical issue is that SOFR has shown itself to be more volatile than the EFFR, and it is important for market participants to understand how this may affect the associated discounting. Figure 1 presents the SOFR curve and the associated OIS curve constructed on two different days. One of these is September 30, which is the end of a quarter, when the rate typically shows a noticeable spike. The second is October 2 – a normal business date.

At the front of the SOFR curve, up to two years of tenor, we constructed the curve using SOFR futures, which are the most liquid SOFR derivatives available in this tenor range – and are also, overall, the most liquid instruments across all the tenors. In the context of SOFR discounting, we used SOFR-Federal Reserve Board funds basis swaps at tenors longer than two years. Note that there are other choices of SOFR derivatives, such as SOFR-Libor basis swaps, which can result in quite different SOFR curves, mainly due to market liquidity. Furthermore, curve construction usually involves accommodating events such as central bank meetings dates and turn effects. To keep the focus on curve behaviour, this analysis avoids these fine details, with the exception of indicating that flat forward-rate interpolation was applied at the front section of the SOFR curve.

Figure 1 shows that the SOFR rates are 2.35 and 1.85 on September 30 and October 2, respectively. The difference of 50 basis points in this overnight rate has an observable impact on the SOFR curves at the short tenor and up to around five years, as presented in figure 2. This also impacts the corresponding OIS curves, which move very closely with SOFR given the basis spread between the two doesn’t change by much. This is reflected by the curves on the plot in figure 2. At the end of a quarter, the September 30 curves carry the higher rates in the front, but the October 2 curves are much lower. Comparing the curves, which represent the one-day forward rate, it can be observed that in the front end the lowest points of September 30 and October 2 differ by more than 10bp, which is a considerable difference.

At the longer tenor range, however, the SOFR curves at the two dates merge into a single curve, partly because of the lack of liquidity of the SOFR derivatives market at that range. The OIS curves exhibit similar behaviour. This means rate fluctuation is only effective for short tenors.

Because the SOFR-fed funds basis spread is negative at the front end of the curve and turns positive at longer tenors on both dates, the SOFR curve crosses the OIS curve as the tenor increases. As a secured benchmark rate, one would usually expect the SOFR rate to be lower than the EFFR, because the latter contains minor risk components. The observed ‘sign flip’ of the basis spread is most likely due to supply and demand within the SOFR market.

Understanding discounting risk

The transition to SOFR discounting means market risk will now be dependent on SOFR instead of OIS, and this could require completely different hedging vehicles. Thus, an important question market participants must ask themselves is: “Are we ready for this transition in discounting method?”

Figure 3 illustrates, on a set of key tenors, the one-day forward rate as of September 30 compared with the same calculation on October 2, together with the same comparisons for discount factors.

The first thing one might notice is that the forward rate difference between SOFR and OIS on the same date doesn’t change by much. This is what we expect due to the market quotes of the basis spread between the two rates. However, if one compares just the OIS forward rates or just the SOFR forward rates on the two dates, one will see a substantial amount of difference at the short tenors. There are upwards of 10bp differences for the tenors up to five years. As the tenor increases from there, the spread becomes smaller. But still, even at 30 years, the SOFR rates on the two dates differ by more than 3bp, which is not a small difference.

To understand the impact on the present value of a future cashflow, one should look at the discount factors. The first observation is that SOFR and OIS discounting can differ substantially, especially at the longer tenors: the 25- and 30-year discount factor differences are greater than 30bp and 40bp, respectively. Meanwhile, even in the two- to five-year range, the difference is more than 10bp, which is not insignificant.

At the same time, the difference between the discount factors of OIS and SOFR does not change much between the two dates. However, the discount factors of the SOFR rate noticeably changes between the two dates – even larger than the difference between the SOFR and OIS discount factor. This would pose a challenge in risk management, given that the SOFR derivatives market is not liquid enough for efficient hedging.

This provides a strong indication that, as a hedge instrument, the SOFR-fed funds basis swap may be useful as it is the most relevant SOFR instrument available concerning the discounting risk. If one wants to replicate the original OIS DV01 – the sensitivity to a 1bp move in interest rates – which might already be hedged, one can use a SOFR-fed funds basis swap, cancel out the SOFR cashflow and replicate the original sensitivity on the OIS discounting. For this reason, CME and LCH will provide the risk compensation using SOFR-fed funds basis swaps when they switch from OIS to SOFR discounting in October 2020. It also explains why cash-only compensation is not preferable as long as the overnight repo market remains volatile. It would capture only a snapshot of the SOFR-fed funds market on the discounting switch date and won’t be enough to follow the subsequent day-to-day market changes, which can have significant impact on profit and loss.

To recap the key takeaways from these statements:

- Understanding the full effect of SOFR discounting will be key to understanding its significance for trading and risk management.

- Market risk will now be dependent on SOFR instead of OIS, and this could require completely different hedging vehicles.

- As a hedge instrument, a SOFR-fed funds basis swap may be more useful because it is the most relevant SOFR instrument available concerning the discounting risk.

In addition, it is important to know that switching from OIS to SOFR discounting will reshape future cashflows. This is because the swap and Libor rates, which are commonly used as the underlying of the interest products, will be impacted by the SOFR discounting.

What SOFR discounting means for your business

When you think about the practice of SOFR discounting for your own business, the likelihood is that your practice will not be static in terms of how you produce the SOFR curve. It will depend on where market liquidity is moving at a given time and how you want to address your specific business needs as it regards curve construction. What is crucial is to ensure you always have correct valuations and appropriate risk management – particularly during the period of the Libor transition.

About the author

Ping Sun is senior vice‑president of financial engineering at Numerix as well as the product manager of the Numerix CrossAsset analytics platform. He was a postdoctoral fellow at Rutgers University and earned a doctorate degree in physics from The City College of New York. Sun also received an undergraduate degree in physics from Fudan University in Shanghai.

Libor Risk – Quarterly report Q1 2020

Read more

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net