Advanced measurement approach (AMA)

Banking on a more advanced approach

Banks must review their advanced measurement approach models if they are to experience a smooth transition under the new Basel II regime. By Thomas Kaiser, of consultants KPMG

The cream of the crop

OpRisk & Compliance Achievement Awards

Risk information: science or art?

Industry experts gathered for a roundtable discussion in New York at the end of May to debate the ways firms acquire and use information about risks. Moderated by Ellen Davis

Defining the boundaries

Him Chuan Lim, Basel II programme director at DBS Bank in Singapore, talks to Ellen Davis about operational risk's complex relationship with both credit risk and market risk

Future options

Operational risk derivatives have been touted for a few years now, but interest in them moves in waves. The current tide is high, however. Duncan Wood tests the water

The principles of distribution fitting

TECHNICAL

Room for improvement

Sungard tops our survey of software vendors, its products proving a hit across the op risk and compliance spectrum. But op risk executives continue to demand more from the software industry, reports Dianne See Morrison

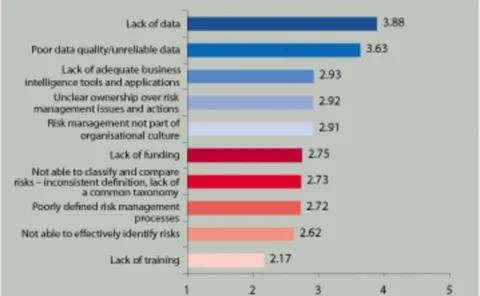

Untangling the risk information knot

In a new OpRisk & Compliance Intelligence survey, sponsored by BearingPoint Management & Technology Consultants, data issues rank high on the risk executive's list of problems. Can Web 2.0 change the face of risk information collection?

Profile: Joe Sabatini and the rules of engagement

The guiding principles of Basel II are now shrouded in mists of regulatory detail, says JP Morgan's Joe Sabatini. He tells Duncan Wood op risk managers must now look beyond mere compliance, and focus on adding value to their firms

Resolving the confusion

Risk control self-assessments have become a Tower of Babel for the op risk discipline, with a variety of different approaches being taken. Ellen Davis reports

Basel Committee issues CP on AMA home-host supervisory co-operation and allocation mechanisms

Basel Committee out with proposals on home-host supervisory co-operation and allocation mechanisms under the Advanced Measurement Approaches.

Time for change

Implementation of the core principles of op risk still has a long way to go in the Asia-Pacific region. Ellen Davis reports

Event horizon

Rick Cech takes a second look at what makes up operational risk event types, and asks if there is a more advanced way to define them

Debating RCSAs

Four of the industry's top op risk executives debated risk control self-assessments at a recent briefing in London, moderated by Ellen Davis and sponsored by software vendor Reveleus

Financial Services Authority issue latest guidance on Advanced Measurement Approaches to operational risk

FSA reinforce their commitment to full implementation of the AMA sections of the CRD

Flag-waving (not wavering)

As an American living in London, I've been acutely aware of the differences a small body of water can make to people's perceptions on certain issues.

US Basel II gone AWOL

Well, has Basel II finally ridden off the rails in the US? This seems to be the case. The inclusion of a new study on Basel II, to be conducted by the General Accounting Office, does rather seem to threaten the timetable that the US regulators announced…

Basel committee clarifies calculation of expected operational risk losses for AMA

The Operational Risk Subgroup of the Basel Committee Accord Implementation Group (AIGOR) has released further guidance on how banks can adequately capture expected losses (EL) in their business practices.

Scenario analysis: the way forward

Of the four elements that Basel uses as inputs for the AMA, scenario analysis has only recently been seen as perhaps the most important.

BMO Financial Group selects Reveleus for Basel II Compliance

BMO Financial Group (BMO), the Canadian-based financial services corporation, has selected the Reveleus Basel II Solution for its Basel II compliance requirements.

LDCE results show risk sensitivity in US banks, says Rosengren

NEW YORK – Initial results of the loss data collection exercise (LDCE) show that US Basel II banks are holding operational risk capital that is proportional to their losses, according to Eric Rosengren, senior vice-president at the Federal Reserve Bank…

How op risk mitigants affect regulatory capital

For banks to develop an efficient operational risk hedging strategy, they need to consider the capital impact of the four main mitigant types: insurance, business continuity management, controls and staff training. By Niclas Hageback