Energy Risk

Top of the agenda

Energy Risk's inaugural risk management survey reveals what you consider the biggest challenges, greatest fears and chief problems facing risk managers today, and what changes you would like to see in the future

Playing power games

Thanks to increasing consolidation, it seems the country-specific energy exchange will soon be a thing of the past in Europe. But is this level of competition premature?

Editor's letter

Surely in this post-Enron, Sarbanes-Oxley world it was now safe to go back in the water?

Credit in the limelight

Today's business climate is pushing credit risk higher up the risk management agenda, as our Energy Credit Risk conference in New York showed. Stella Farrington reviews the event

Off to a flying start

Aviation is one of the fastest growing sectors in terms of carbon emissions, but a move by the European Commission to include airlines in the EU's Emissions Trading Scheme has alarmed some in the industry

A matter of principal

Developing term structure models can be tricky, as unknown factors and non-observable variables can affect futures prices. But principal components analysis is useful in tackling these problems. Here, Delphine Lautier uses PCA to pin down price movements…

Top tips and dirty tricks

You don't have to be a genius to work as a quant - though it helps - but you do have to know a few tricks of the trade. So where should aspiring energy quants start? Neil Palmer offers some suggestions

Papering over the cracks

High energy prices are forcing pulp-and-paper makers to take action against falling profits, yet most companies are still shying away from energy price hedging. But that situation may be slowly changing. Joe Marsh reports

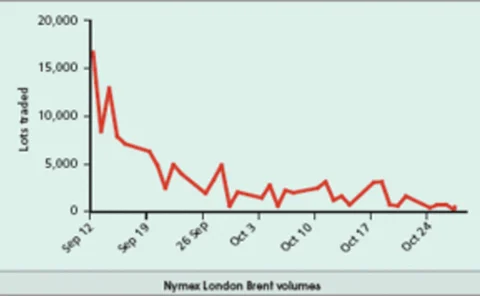

Refco raises further concerns

As the Refco bankruptcy case rumbles on, investors are wondering if more could have been done to prevent it, and in future, are likely to seek better assurances over the security of funds in segregated customer accounts

National Bank of Canada reunites heavy hitters for energy push

National Bank of Canada (NBC) has expanded its energy derivatives team in Calgary with three new managing directors, with the aim of attracting more utility and energy-consumer customers.