Energy Risk

The scandal in Sudan

A fragile peace may at last have come to Sudan after 21years of civil war, but a bitter and unresolved dispute over oil exploration acreage in the south of the country couldendanger that peace. Report by Maria Kielmas

A disciplined approach

E&P companies tend not to strategically hedge in a rising market. But there are good reasons for them to do so, and some are sticking to their hedging strategies, despite suffering losses on their derivatives contracts. By Joe Marsh

James Tweed and Dave Wardley

At the end of last year, JAMES TWEED and DAVE WARDLEY launched the first hedge fund dedicated solely to trading freight. Stella Farrington meets them

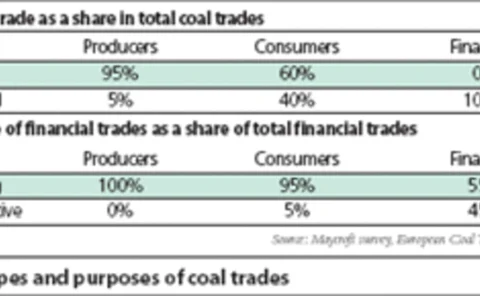

Coal facing changes

Coal

Trading routes open

Coal

Icap to acquire United Fuels International

Interdealer broker Icap is to acquire the majority of the assets of United Fuels International, a leading US-based energy broking business with 2004 turnover of $24 million.

EEX launches French physical power futures

Germany’s European Energy Exchange (EEX) has started offering physical power futures with delivery in France, another step towards its stated aim of further ‘Europeanisation’. This is the second product the EEX has offered beyond German borders,…

GFI buys Starsupply

Interdealer broker GFI Group has agreed to acquire Starsupply Petroleum, a leading broker of oil products and related derivative and option contracts.

Lufthansa continues to save through fuel hedging

German airline Lufthansa has reported a increase in operating expenses of only 1.3% despite a big surge in fuel prices, partly thanks to its fuel-hedging strategy.

Great expectations?

Risk and expectation are two sides of the same coin. But could you quantify your own risk appetite? explores some ways to put a price tag on those hazards you can’t avoid Neil Palmer

TFS brokers first Nymex emissions contract

Global broker Tradition Financial Services (TFS) has brokered the first transaction on the New York Mercantile Exchange (Nymex) emissions futures contract.

Evolution expands US west coast emissions brokerage ops

Energy broker Evolution Markets has expanded its environmental market operations for the western US with the hire of Laura Meadors, an expert in environmental market design and analysis. She is based in the San Francisco office, which opened in February…

Delivering the goods

There’s huge scope for growth in the freight derivatives market, but to attract more players, existing participants need to adopt more innovative and sophisticated trading practices, participants say. Stella Farrington reports

Chris Bowden

With energy prices skyrocketing, risk management is now a necessity, not an option, says energy risk pioneer Chris Bowden . By Stella Farrington

The energy equation

Quantitative analysis in the energy industry is undergoing a crucial transition as it moves out of the role of secondary support to sit at the heart of business decision-making. Stella Farrington looks at its advance

Pipelines and politics

The latest in a long line of disputes over natural gas supplies from Russia is raising concern among utility customers and investors that future supplies to the West may be disrupted. But is this a long-term problem? Oliver Holtaway reports

Growing up fast

Weather trading is seeing strong volume growth in the US, largely due to the influx of hedge funds into the market. Why such a big increase in interest, and what sort of strategies are the funds adopting? By Joe Marsh

Weatherproofing the VAR

The weather derivatives market shares some similarities with other markets, but applying existing models can sometimes have disastrous results. Brett Humphreys and Eric Raleigh discuss how weather derivatives differ from financial derivatives and how we…

Making an impact

It can affect as much as 20% of the US economy, and nearly every industry worldwide is affected by it. But blaming poor results on the weather is no longer an excuse: weather derivatives are on the rise. Eric Fishhaut reports from Chicago on the growth…