Operational risk

The end of the boom-boom room

Compliance Sex Risk

Losses and lawsuits

Loss Database

Coso ERM framework lacks 'how-to' details

Corporate Governance

IM scare for securities trading firms

Management Intelligence

SOX requirements 'too consuming'

Management Intelligence

EC launches corp gov forum

Corporate Governance

Algorithmics pushes op risk product

Measurement Advances

FSA to conduct Basel II implementation QIS

Regulatory Update

Sponsor's article > With a bang or a whimper?

Inconsistent pricing across traditionally segmented markets has been greatly reduced in recent years. Much of this improved market efficiency is due to the efforts of hedge funds. David Rowe argues, however, that the very success of these funds may be…

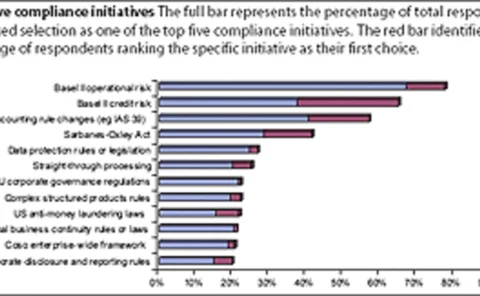

The dubious benefits of compliance

Survey Risk-Based Compliance

Integrated compliance efforts: business benefits beyond regulatory mandates

Corporate Statement

The top stories from RiskNews

Feature

Sponsor's article > SunGard to rise again

SunGard, the 900-pound gorilla of the financial sector software market, has been strangely absent from the operational risk software arena so far, according to both financial and technology industry executives. Now, however, that looks set to possibly…

Rounding up the black sheep

The collapse of BCCI in 1991 provided much of the impetus for Basel II's home-host regulatory framework. But supervisors say that recognising the need for regulatory co-ordination is just a first step in a long journey.

Tattersall leaves FSA

Colin Tattersall, head of op risk policy at the UK's Financial Services Authority, has left his post at the supervisor. Market sources say he is set to join the Irish Financial Services Regulatory Authority's Basel II implementation efforts, based in…

US regulators outline QIS4 process

US regulators are busy finalising the text for the fourth quantitative impact study (QIS4), which they expect to issue at the end of October to the banks participating in the exercise.

The Compliance Pain

Increasing regulatory oversight and static IT budgets create compliance headaches for the CIOs and CTOs of DrKW, Evergreen Investments, and JPMorgan Investor Services.

The Compliance Pain

Increasing regulatory oversight and static IT budgets create compliance headaches for the CIOs and CTOs of DrKW, Evergreen Investments, and JPMorgan Investor Services.

Learning from Esops' fables

France's SNCF is concentrating on the risks, particularly the operational ones, associated with its new employee savings programme. Duncan Wood reports on its progress, and throws light on the various other Esop-type products on the market.

Quantifying hedge funds' operational risks

Operational risk

Rounding up the black sheep

Regulation: Home-Host

Fannie Mae ordered to appoint chief risk officer

Management Intelligence

Isda OTC derivatives project gathers speed

Management Intelligence

Tattersall leaves FSA

Regulatory Update