Operational risk

Trojan horse rules by John Thirlwell, ORRF

INDUSTRY COMMENT

Insolvency: a survival guide

The collapse of Parmalat has forced European legislators to take a long, hard look at the laws governing insolvency. Moves are now afoot to bring these regimes more in line with a Chapter 11 style of bankruptcy legislation, as Oliver Holtaway discovers

A solution to counterparty credit risk?

The race is on to find a solution to outstanding issues such as counterparty risk, double default and the treatment of illiquid assets on trading books before Basel II is enshrined in regulation.

Basel II: capital concerns

Basel II has forced banks, long the mainstay of lending to European corporates, to re-evaluate the amount of money they lend. However Alan McNee reports that far from leading to a huge drop in bank lending, Basel II may actually have the opposite effect.

US agencies issue QIS4 and LDCE survey materials

American financial regulators (the Agencies) have issued survey materials for the fourth Quantitative Impact Study (QIS4) and the Loss Data Collection Exercise (LDCE) in preparation for the implementation of the Basel II capital framework in the country.

US agencies issue QIS4 and LDCE survey materials

US financial regulators have issued survey materials for the fourth Quantitative Impact Study (QIS4) and the Loss Data Collection Exercise (LDCE) in preparation for the implementation of the Basel II capital framework in the US.

Sand, sea and securities

international financial centres

Slave to the rithm

algorithmic trading

Alternative investments: asset allocation in multimanagement

asset allocation

From Russia... with gloves on

Shareholder activism in Russia has historically been a distinctly dangerous pastime, but for investors in The Hermitage Fund and its manager William Browder, it has produced returns of 990% since 1996.

The objective advocate

business profile

Learning to live with currency normality

Risk management

Meeting the challenge of Basel II head on

Banking sector

Hedge funds solve the risk culture puzzle

As recent reverses amply demonstrate, risks beyond investment risk can cause even the most sophisticated hedge funds to take a battering. Navroz Patel finds out about leading managers' greatest fears, and how they are tackling thorny issues such as…

Structured credit desks woo retail investors

retail CDO bid

Tail dependency in op risk models

Practitioner's Corner Modelling

Samad-Khan quits SAS

Measurement Advances

Briefs

Management Intelligence

The organisational turf war

Internal Strategy Turf War

Briefs

Measurement Advances

A foundation for KPI and KRI

Technical Focus KRIS & KPIS

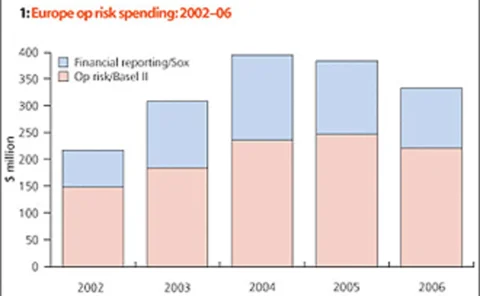

Where did the big SOX spend go?

Compliance Sarbanes-Oxley

IM scare for securities trading firms

Management Intelligence