Basel Committee

Reopen for business

As GAM reopens some of its multi-fund hedge portfolios to new investors, David Smith reflects on the hedge fund industry, GAM's progress and staggering intake of money in 2004

From Basel II to Basel III

Portfolio risk

FSA releases Basel II information

REGULATORY UPDATE

Emerging markets failing to plug into AMA

Regulatory News

Has Asia got the balance right?

SPECIAL FOCUS EMERGING MARKETS

Counterparty risk – the next generation

Risk analysis

Sourcing the single-system solution

As head of the Basel project office at Bank of New York, Nicholas Silitch faces the toughest challenge of his 20-year career at the bank.

Risk management is not just about quantitative models, says Schmidt Bies

Effective risk management is more than technical skills in building internal models, and needs qualitative factors of experience and sound judgement, according to governor Susan Schmidt Bies of the US Federal Reserve.

We need a common definition of ‘validation of internal models’ across countries, says OCC

The lack of a common definition of the ‘validation process’ of the internal credit risk measurement models across countries could cause problems in the cross-border risk management under the new Basel Accord, Basel II, according to New York-based Mark…

We need a Basel Accord that emphasises economic not regulatory capital, says Gilbert

Even before the new Basel Accord, Basel II, is implemented, some risk managers already see a need for a Basel III process to rectify flaws in Basel II.

Global banks concerned over host discretion

REGULATORY UPDATE

First glimpse of CEBS's Pillar II at op risk event

REGULATORY UPDATE

QIS4 set to go international in 2005

BASEL, SWITZERLAND – Quantitative impact study four (QIS4) is about to go international, according to sources in Basel, the US and the EU. Although the Basel Committee on Banking Supervision won't take the co-ordinating role it did during previous QISs,…

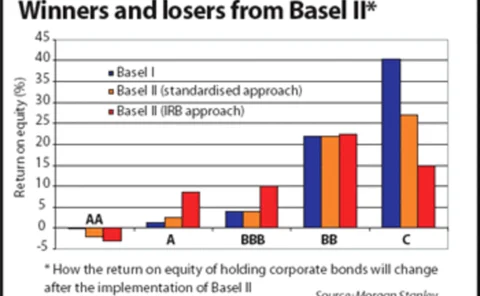

Basel II to boost bank bondholdings

Basel II could have a major impact on the bond markets, according to a new report from Morgan Stanley.

US financial institutions face major challenges under Basel II, says Financial Insights

Financial institutions in the US face tremendous challenges under the new Basel Accord, also known as Basel II, according to Financial Insights, a financial services research firm based in Framingham, Massachusetts.

A solution to counterparty credit risk?

The race is on to find a solution to outstanding issues such as counterparty risk, double default and the treatment of illiquid assets on trading books before Basel II is enshrined in regulation.

Basel II could be detrimental to the industry, says Labarge

The implementation of the new Basel Accord (Basel II) will be more difficult than earlier envisioned, and could be disruptive to the banking industry, according to Suzanne Labarge, former Royal Bank of Canada chief risk officer (CRO).

Basel II: capital concerns

Basel II has forced banks, long the mainstay of lending to European corporates, to re-evaluate the amount of money they lend. However Alan McNee reports that far from leading to a huge drop in bank lending, Basel II may actually have the opposite effect.

US agencies issue QIS4 and LDCE survey materials

American financial regulators (the Agencies) have issued survey materials for the fourth Quantitative Impact Study (QIS4) and the Loss Data Collection Exercise (LDCE) in preparation for the implementation of the Basel II capital framework in the country.

Meeting the challenge of Basel II head on

Banking sector

Basel II: the global challenge

Profile

Court and the act

Sarbanes-Oxley