Basel Committee

Falling short of the mark

Operational risk

Malaysian central bank governor cautions on Basel II

Zeti Akhtar Aziz, the governor of the Central Bank of Malaysia, has said that other financial leaders in emerging economies should be cautious about how they implement Basel II.

CRO Forum study released

Industry body the Chief Risk Officer (CRO) Forum, which consists of the chief risk officers of Europe's leading insurers, is advancing the case for the use of proprietary internal models under Solvency II with the publication of a new in-depth report.

AIG group to tackle governance and data

BASEL, SWITZERLAND – The Accord Implementation Group's (AIG) operational risk working group is focused on tackling internal governance and data issues at its next meeting, according to an international regulatory source.

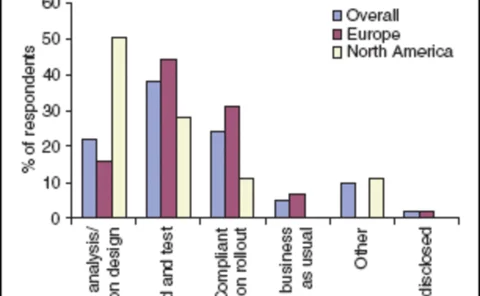

Basel II costs rising, says survey

A survey of banks in Europe and North America, sponsored by the consultancy firm Accenture, has found dwindling optimism and rising predicted costs for the implementation of Basel II, with the cost of compliance now estimated to be £2.5 billion for the…

Indian banks call for additional Basel II guidance

Indian banks have called on their regulator, the Reserve Bank of India (RBI), to provide adequate guidance for the implementation of the new Basel Framework for Minimum Capital Requirements, also known as Basel II, according to a survey by the Federation…

Briefs

REGULATORY UPDATE

FSA/CEBS co-ordination under fire

COVER STORY

Basel puts QIS5 on starting blocks

REGULATORY UPDATE

The Secret CDO

Cover Story

Basel II costs rising, says survey

New angles

Pricing the weather

Pricing weather derivatives is different from valuing other derivatives contracts – actuarial methods play a greater role. Steve Jewson looks at the varied approaches available

The final countdown

The Basel Committee's most recent quantitative impact study shows a wider variation in capital among participating banks than many had been expecting. But Gerhard Hofmann, Germany's representative on the Basel Committee, reckons Germany's banks are well…

Is Basel II a hurdle too far for US broker-dealers?

Broker-dealers in the US are having to cope with the SEC's capital requirements, while still being somewhat in the dark about the upcoming Basel II framework. By Choongo Moonga

QIS4 results show additional capital is needed, says S&P

The early results of the Fourth Quantitative Impact Study (QIS4), which show a significant reduction in Basel II regulatory capital in Germany and the US, point to the need for additional capital charges under Pillar II of the new banking framework,…

Basel Committee clarifies 'Downturn LGDs'

The Basel Committee has issued clarification relating to the quantification of loss-given-default (LGD) parameters used for Pillar 1 capital calculations, as requested by banks and national bank supervisors. The LGD Working Group, established in…

Basel Committee issues QIS5 instructions

The Basel Committee has released instructions for the fifth Quantitative Impact Study (QIS5) for Basel II, to be conducted between October and December 2005.

New op risk papers

LONDON – A raft of new technical papers on operational risk have been made available on the web over the past few months. A few of the most interesting are summarised below:

Sponsor's article > AFS Perspective on Basel II and QIS 4:Where do we go from here?

U.S. federal banking agencies recently announced results of the fourth in a series of quantitative impact studies (QIS-4) designed to simulate implementation of the Basel Accord and measure the resultant impact on U.S.financial institutions' capital…

Two new consultation papers from CEBS

LONDON – The Committee of European Banking Supervisors (CEBS) launched two substantial consultation papers in June – one on the supervisory review process and the second on credit rating agencies.

South Africa outlines Basel II challenges

South Africa has to amend its banking regulatory framework to accommodate the requirements of the new Basel Capital Accord, Basel II, says Errol Kruger, South Africa's Registrar of Banks and general manager of the supervision department at the country's…

European ABS: Will it end in tiers?

As part of a special focus on asset-backed securities, we take a look at the European ABS market. After a prolonged period of spread compression, credit tiering may be making a return to the market, as Alan McNee reports

Two new consultation papers from CEBS

REGULATORY UPDATE