Basel Committee

Europe's managers find joy in their own distress

distressed debt

Apra exec defends modifications

REGULATORY UPDATE

New QIS5 gives more PD and LDG leeway

REGULATORY UPDATE

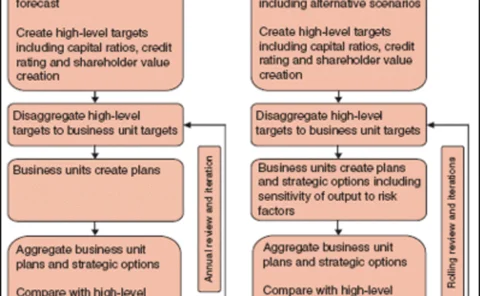

Building a capital plan

Basel II

Whither stress testing?

Risk analysis

RiskNews

RiskNews

Legal spotlight

In our new series bringing legal issues under the spotlight, Simon Gleeson, partner in Allen & Overy's regulatory group in London, outlines the key regulatory changes now shaping the bond markets

Sponsor webcast>> From compliance to better business - making the case for implementing a Basel II solution

Compliance with the Basel II Accord means being able to identify, generate, track and report on risk-related data in an integrated, automated and transparent manner. It also presents a unique opportunity to improve your enterprise risk management…

European Parliament gives green light to Basel II

The European Parliament has voted to adopt the new rules governing the Capital Requirements Directive, which will implement the Basel II framework in the EU.

Scenario analysis: the way forward

Of the four elements that Basel uses as inputs for the AMA, scenario analysis has only recently been seen as perhaps the most important.

MAS consults on Basel

SINGAPORE – The Monetary Authority of Singapore published a consultation paper that outlines proposed rules and guidelines on parts of its Basel II implementation programme in August.

Basel II to reduce capital on rated securitisation positions

The minimum capital requirements under the new Basel framework, also known as Basel II, will lower the amount of capital that implementing banks will be charged for rated securitisation positions, according to new research by FitchRatings, the rating…

Most US lenders would survive bursting of a real estate bubble

Research by Standard & Poor’s suggests that most US mortgage firms would be able to withstand the bursting of a US housing bubble, despite the greater credit risk associated with current mortgage portfolios.

Pillar II problems cause tempers to fray

LONDON – Tempers are continuing to boil over proposed Pillar II regulatory implementation, both in the industry and at the UK's Financial Services Authority (FSA). One attendee at the late July Pillar II standing group meeting described the event as …

Falling short of the mark

Financial institutions have struggled to develop operational risk frameworks that will improve business decisions and optimise their use of economic capital. And a new study indicates that op risk is now increasingly viewed as yet another compliance…

Taking the slow road to Basel II

Brazil’s central bank published Basel II implementation guidelines at the end of last year,giving the country’s banks a firm timetable for the introduction of the new framework.What progress have banks made so far? John Ferry investigates

Legal spotlight

Legal spotlight

MAS consults on Basel

REGULATORY UPDATE

A new era for Italian op risk

ITALY IMPLEMENTATION

Briefs

REGULATORY UPDATE

Pillar II problems cause tempers to fray

REGULATORY UPDATE

Filling the ratings void

Cover story

Managing China risk

Profile

The new market risk

Risk analysis