LCH

LCH SA incurs record number of margin breaches in Q1

Largest initial margin shortfall amounted to €100 million

SwapClear incurred a $558m margin breach in Q1

Liquidity and concentration add-ons covered 41% of mark-to-market exposure

Initial margin – Special report 2020

Buy-side firms in advanced preparations for phases five and six of initial margin (IM) rules are eager to maintain momentum and put their efforts to the test now that implementation has been delayed by 12 months following disruptions related to the Covid…

Strategic preparation – The impact of the UMR phase five delay

Bruce Kellaway, global head of rates, securities and collateral at LCH, discusses the most likely instruments to be pushed into the cleared world as a result of phase five implementation, the tactics firms use to drive efficiency in exchange threshold…

Libor webinar series – Liability-driven investment fund managers and investors

Nobody knows what will happen to Libor at the end of 2021, but the market has to be ready for anything – including the benchmark’s demise. This continues to be the message from regulators, despite the havoc caused by the Covid-19 pandemic. The coming…

Key steps in the transition to SOFR

Phil Whitehurst, head of service development, rates, SwapClear at LCH, offers his insight into when a term structure for the secured overnight financing rate (SOFR) is likely to be established, what will be required for this to become a reality and what…

Clearing banks feel pinch as rates turn negative

Negative returns on dollar deposits at Eurex, Ice and LCH spur talk of business model change

Swaptions compensation method divides market

US and European firms back redress payments, but disagree over how they would work

People moves: Brevan Howard risk head moves to Coremont unit, Pimco PMs, and more

Latest job changes across the industry

LCH, HKEX to clear swaps linked to Asia overnight rates

Clearing houses ready launch of SORA and Honia swaps, but timing is uncertain

EU ‘non-paper’ reveals new effort to delay CCP open access

Negotiations on CCP recovery and resolution could provide a route to postpone Mifid rule

CCPs postpone euro discounting switch to July

Five-week extension agreed after working group proposal for September delay fails to find consensus

Eurex seeks Hong Kong clearing licence

Bourse has Greater China in its sights after Japan and Singapore licences approved

CCPs built up liquidity buffers heading into 2020

LCH SA grew qualifying liquid resources 49% year on year

LCH suffered longest operational outages of top CCPs in 2019

London-based LCH LTD said core systems were down for almost seven hours in 2019

Entering 2020, most CCPs had bigger default funds than a year ago

Majority of back-up funds to handle member defaults saw more pre-funded resources flow in

Libor webinar playback: spotlight on derivatives

Panellists from Deutsche Bank, LCH, Numerix and Tradeweb on transition timelines, volatility and discounting

Libor Risk – Quarterly report Q1 2020

Regulators may have to accept Libor transition will be slower than they hoped. But the final framework may yet be more robust as a result. Knowing how rates perform in times of stress will be crucial to the success of benchmarks intended for real economy…

Pre-cessation Ibor picture gets clearer

As the derivatives market has accepted the impending transition away from interbank offered rates, attention has turned to how best to manage it. Philip Whitehurst, head of service development, rates at LCH, explores how the clearing house is working…

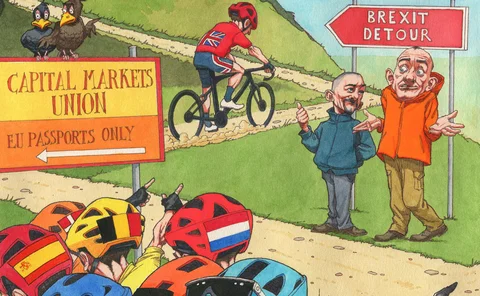

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

ECB mulls wider clearing house access to account facilities

Including CCPs in the Eurosystem may remove the need for them to seek a banking licence

LCH targets hardwired pre-cessation triggers

Proposal aims to align transfer pricing for cleared and bilateral markets in the event of split on ‘zombie Libor’ triggers

Top five clearing members dominate CCPs

Thirteen of 25 clearing services surveyed have 50% or more open positions in hands of top five members

At CCPs, sovereign bonds are top IM collateral

Government debt makes up 48% of IM on average among top clearing houses