LCH

LCH plans 2020 switch to SOFR discounting

Users opt for one-step switch to new US dollar regime, as long as CCP cooks up compensation scheme

SOFR, so bad: liquidity lags transition ambitions

Thin current trading may lead to poor fallback choices, and dim SOFR’s appeal ahead of Libor’s death

DTCC, Ice Clear Europe lead top CCPs in boosting liquidity buffers

CCPs added $20.8 billion to their liquidity buffers in the third quarter of 2018

SwapClear compressed notional leaps 27% in 2018

$774 trillion of notionals compressed, up from $609 trillion in 2017

LCH shakes up compression vendor fee structure

Proposals follow criticism that current regime favours top provider TriOptima

LCH launches CDS exercise platform

CCP touts method for speeding up manual settlement process as rival Ice gears up for options launch

Swaps data: volumes up amid volatility

Data shows strong growth in cleared OTC derivative volumes in second half of 2018, says Amir Khwaja

Clearing house innovation of the year: Eurex Clearing

Risk Awards 2019: CCP’s incentive scheme takes on LCH to capitalise on Brexit uncertainty

Clearing houses urge CFTC to act on non-default losses

US clearing members divided on whether NDLs are CCPs’ responsibility or a mutual risk

Banks warned on holes in EU’s proposed Brexit relief

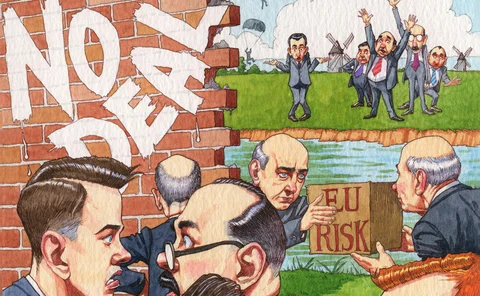

Potential EC, French and German no-deal relief is expected to be short-lived and incomplete

BlueCrest seeks direct membership at LCH’s SwapClear

Investment firm to make leap away from clearing broker reliance

Banks demand greater scrutiny of CCP margin add-ons

Nasdaq Clearing blow-up prompts questions over CCPs’ methods of applying top-ups to concentrated positions

Birchall to head LCH Asia, and more

Latest job changes across the industry

SGX to exit swaps clearing business

Decision will leave some contracts without a CCP from next April

People moves: Piterbarg joins NatWest Markets, Le Brusq leaves Natixis, and more

Latest job changes across the industry

Top 10 CCPs plump liquidity buffers by $20 billion

Increase driven by higher secured deposits at commercial banks and expansion of credit lines

LCH units bolster liquidity buffers

Cash at central banks and with commercial banks higher in the second quarter

Stuck in traffic: EU turf war holds up CCP resolution rules

Unsuitable rules for failed banks could be used to resolve French and German clearing houses

Asia moves: SFC names new chairman, LCH hires regional head, and more

Latest job changes across industry

People moves: TSB chief exec quits, Eurex loses two execs, new cyber chief at Commerzbank, and more

Latest job changes across the industry

Swaps data: Sonia growth spreads down the curve

New figures show boom in sterling OIS swaps is not limited to short-dated trades

Day one of a no-deal Brexit: swaps and chaperones

Banks, trading platforms, repositories tee up EU entities – and dread the repapering crunch that would follow

LCH cancellation notices, Eurex incentives and prop trader rules

The week on Risk.net, September 29 – October 5, 2018

EU clients face axe from UK CCPs

But Esma’s Maijoor offers lifeline, calling for continued access for EU members